Préstamos

Encuentra la opción de préstamo perfecta para ti: ¡Explora las mejores opciones!

Finding the ideal loan for your specific needs has never been easier. Simply select one of the options below, and we will provide you with a tailored recommendation for the best loan option available to suit your requirements.

Anuncios

Discover Convenient and Fast Loan Options

Looking for easy and quick loan solutions to secure funds promptly? We’ve got you covered! Additionally, if you prefer having a line of credit to consolidate your debt, we recommend considering zero percent APR credit cards.

Tailor Your Loan Selection to Your Financial Requirements

Do you want more possibilities?

Check if you are pre-approved for credit cards and loans with no impact to your credit score

Serás redirigido a otro sitio

What is the concept of a loan and how does it operate?

A loan refers to a specific amount of money that is borrowed and subsequently repaid, usually with an additional charge known as interest. These funds can be obtained from various sources, including banks, credit unions, or other financial institutions.

The loan amount, repayment duration, and interest rate are contingent on the particular type of loan you opt for. It is crucial to comprehend four essential aspects associated with loans: the principal, the interest rate, the installment payments, and the terms.

Firstly, the principal denotes the specific sum of money borrowed from the lender. For instance, if you borrow $40,000 for home repairs, this amount would be considered the principal.

Secondly, the interest rate signifies the additional amount you must pay on top of the borrowed money. Lenders assess multiple factors, such as your credit score, loan type, and repayment duration, when determining the interest rate applicable to your loan. It is essential to differentiate between interest and the annual percentage rate (APR), as the latter incorporates additional expenses like upfront fees.

Thirdly, installment payments are flexible monthly repayment options designed to assist borrowers in managing their debt obligations. The number of installments can vary depending on the lender and the type of loan you have obtained.

OneMain Financial

Are you interested in applying for a OneMain Financial Personal Loan? Look no further! We're here to guide you through the application process.

Lastly, the term refers to the duration within which you are required to repay the loan in its entirety. This period can vary significantly, ranging from a few days (as seen with payday loans) to months, weeks, or even years.

By considering these crucial elements, you will be better equipped to select the most suitable loan for your needs and gain a clearer understanding of its affordability.

Understanding Loans: How Do They Work?

The concept of a loan revolves around borrowing a specific amount of money that you are obligated to repay over time, typically with an added charge known as interest. These funds can be acquired from various financial institutions such as banks or credit unions.

The loan terms, including the loan amount, repayment duration, and interest rate, depend on the type of loan you choose. To grasp the fundamentals of loans, it’s important to familiarize yourself with four key elements: the principal, the interest rate, the installment payments, and the loan terms.

The principal represents the specific amount of money borrowed from the lender. For instance, if you need $40,000 for home repairs, this would be the principal amount of the loan.

The interest rate refers to the additional amount you must pay on top of the borrowed money. Lenders evaluate factors such as your credit score, the type of loan, and the repayment period to determine the interest rate applicable to your loan. It’s crucial to differentiate between the interest rate and the annual percentage rate (APR), as the latter includes additional costs like upfront fees.

Installment payments are flexible monthly repayment options designed to help borrowers manage their debt. The number of installments varies based on the lender and the type of loan you have chosen.

The loan term indicates the duration within which you must repay the loan in full. This timeframe can range from a few days for short-term loans to several months, weeks, or even years for long-term loans.

By considering these essential elements, you will gain a better understanding of how loans operate and be better equipped to select the most suitable loan option for your needs. This knowledge will also enable you to assess the affordability of the loan and make informed financial decisions.\

Loan Types: Simplified Explanation

There are two main types of loans: secured and unsecured.

- Secured loans: In a secured loan, the borrower provides collateral, such as a house or a car. If the borrower fails to repay the loan, the lender can take possession of the collateral to recover their losses. Common examples include auto loans and home mortgages.

- Unsecured loans: In an unsecured loan, no collateral is required. Lenders assess the borrower’s income and creditworthiness to determine eligibility. Personal loans are a popular type of unsecured loan, used for various purposes like debt consolidation or home repairs. They often come with fixed interest rates.

Student loans are another type of unsecured loan, offering lower interest rates and the option to defer repayment until after graduation.

Credit card companies also provide unsecured loans, but they usually have higher interest rates and shorter repayment terms.

Lastly, it’s crucial to carefully evaluate your options before making a final decision. Taking the time to compare and consider can potentially save you money in the long term.

If you’re interested in enhancing your financial knowledge and taking steps to improve your financial well-being, we highly recommend delving into the topic of credit scores. To gain valuable insights, check out our informative post below!

Tendencias

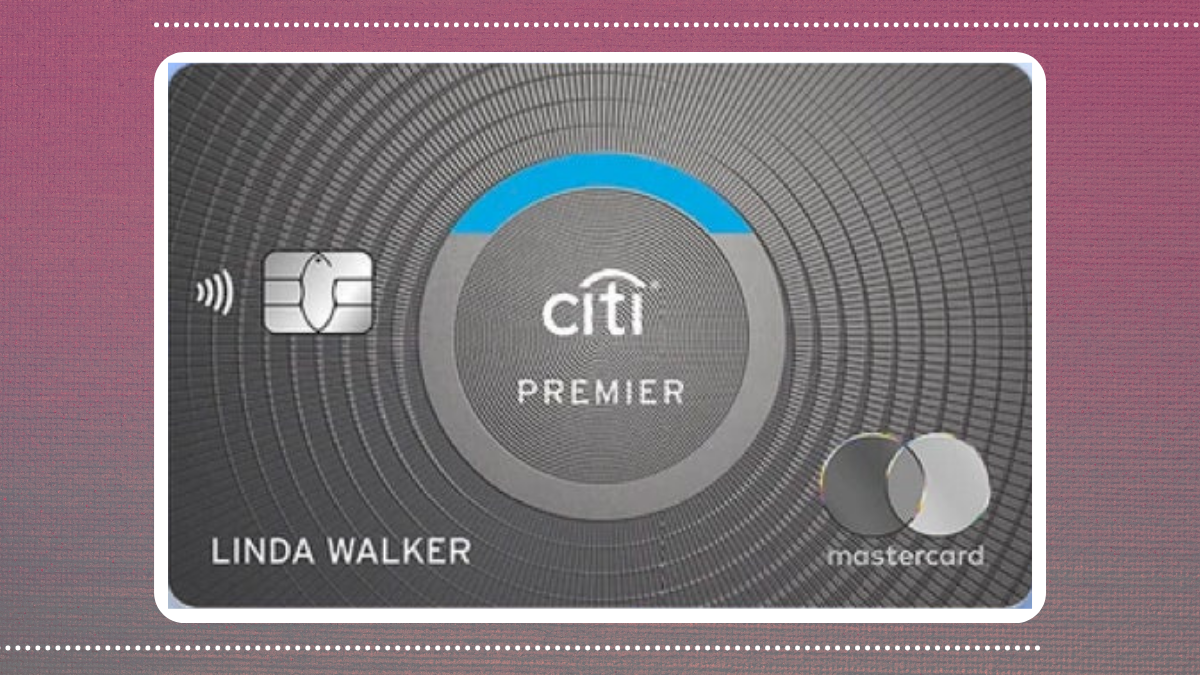

Reseña de Citi Premier®: ¿Vale la pena?

Si buscas una tarjeta de crédito para viajes con excelentes beneficios, deberías leer esta reseña de Citi Premier®. ¡Sigue leyendo!

Continúe LeyendoTambién te puede interesar

Revisión de la tarjeta de crédito Wells Fargo Reflect®: ¡APR introductoria 0% por 21 meses!

Lea nuestra reseña completa de la Tarjeta Wells Fargo Reflect ahora. Ideal para quienes buscan beneficios fáciles. ¡Descúbralo todo!

Continúe Leyendo

Recommendation – Discover® Personal Loan

Learn how to get an amazing loan with Discover® Personal Loans! With Discover® Personal Loans, you'll get your loan in no time!

Continúe Leyendo