Tarjetas de crédito

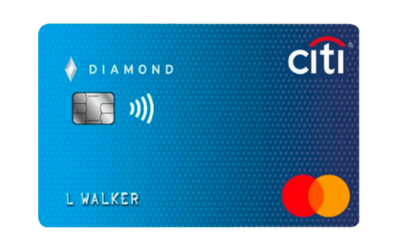

Reseña de la tarjeta de crédito Citi Secured Mastercard®

We've done a full review of the Citi Secured Mastercard credit card, so you can find out more about it! Keep reading. If you want to know everything about and enjoy the benefits.

Anuncios

Meet the Citi Secured Mastercard, which doesn’t require you to have a high credit score and good limit

If you currently don’t have a very high credit score, you’ve certainly come across the likelihood of applying for a credit card and being denied due to your credit, haven’t you? With that in mind, we are going to tell you today about an option that you can consider as the ideal credit card, which is the Citi Secured Mastercard.

Therefore, in this article, we are going to tell you an unbiased review of this card. Highlighting the advantages, disadvantages and basic requirements so that you can order yours in a simple and practical way. In addition, we will also tell you about what are the fees involved in this credit card.

Serás redirigido a otro sitio

Discover the benefits of the Citi Secured Mastercard

As we said earlier, we are going to provide you with a very detailed analysis of this card in order to explain to you what the advantages are. Disadvantages of it in the case of the first advantage that draws the most attention of users is the fact that the card does not charge any annual fee. That is, you can use your card for free without paying anything extra for it.

This is all in addition, of course, to the fact that the card is available to people who have a credit score that is considered middling in the market. For this reason, it can be requested by people who are starting their financial journey now or even restoring their credit limit.

In addition, by having this credit card, you can also later upgrade to another type of card, in case you manage to increase your credit score.

Finally, because the card is offered under the Mastercard brand, you will be able to count on all the advantages involved in this company. After all, this is one of the most widely accepted card brands in the world. It also offers points and rewards programs for its users. Regarding the fees involved in this credit card. It is important to emphasize that they exist, but they are considered very low compared to other cards that offer the same benefits.

26.99%, being variable

Zero

$200 USD

No

Know the requirements to apply for the card

- Be of legal age and present personal documents;

- Have a medium or high credit score;

- It is necessary to make the security deposit fairly quickly, within 14 days of opening the account;

- You must provide proof of residence and income.

What are the disadvantages of this credit card

Now that you know what the advantages of this credit card are, it is also important to keep in mind that it has some disadvantages that we are going to mention now. First, regarding the security deposit, it is important that you know that it needs to be at least 200 USD and it must be paid fairly quickly.

In that case, you will have up to 14 days after account opening to deposit the security deposit amount. And this fact, for some people, can be a little discouraging, as they do not have this amount at hand when opening the account.

Another major disadvantage that we can mention is the time in which your account will be automatically reviewed. That is, it can take up to 18 months after opening the account to determine whether you are eligible to have your security deposit returned, and this is considered long compared to other similar credit card alternatives.

Finally, it is also necessary to keep in mind that this credit card does not have any rewards program, which makes it a not very attractive choice for people who want to spend a lot on the card and have points and rewards received.

How to apply for your Citi Secured Mastercard

Now that you know what the requirements are, it’s time to understand how you can apply for your Citi Secured Mastercard credit card. However, it is necessary to know that the entire process can be done online. Which means you won’t need to go to a bank branch to make your request.

However, at the time of the application it is important that you have personal documents and proof of residence at hand. As well as proof of income. And you will have to wait for an analysis of your registration, after all, a credit check will be made. Because this card is more suitable for people who have average or good scores.

From this, know that you will have to make the security deposit. In this case, you need to have $200 for the deposit, or up to $2,500. And this deposit must be made within 14 days of opening the account. Once this is done, your available credit limit will correspond to your initial deposit and just wait until your card arrives at your residence.

Is the Citi Secured Mastercard credit card a good choice?

As promised, we’ll give you a full review. Whether the card in question is worth it or not. From this point, it is important to know that this card is a little different from other credit cards that have a guarantee. That’s because it is indicated for those who have a medium or good credit score, because if you have a bad credit score, you will probably not be accepted on this card.

Which is quite different compared to other credit cards, with guarantees that are generally more suitable for people who have a below average credit score. However, this card can be a good advantage as it does not charge any annual fees and reports to the top 3 credit bureaus today.

However, as we are giving a true and unbiased review. It is important to know that this credit card, compared to other cards that have a guarantee, may not offer many advantages. Especially taking into account the fact that you must pay the initial deposit mandatorily within 14 days after opening the account. And this can be a little harmful for people who are unable to offer this deposit in this period of time.

Finally, if you don’t have a very good credit score, the Citi Secured Mastercard might not be the right option for you. But if your score is average or good, it might be worth asking for this card!

Also check out Capital One Quicksilver

If you are looking for another secured credit card option that offers advantages to users, we can recommend you a good option. For this, you just need to click on the button below, and you will have access to all the important information about the Capital One quicksilver credit card.

Capital One Quicksilver

¡Descubre todas las ventajas, desventajas y requisitos para solicitar tu tarjeta de crédito Capital One Quicksilver!

Tendencias

Solicitar en Citizens Bank

Si desea obtener más información sobre Citizens Bank y cómo solicitar sus préstamos estudiantiles, ¡debería leer este artículo!

Continúe Leyendo

Revisión de Capital One Kohl's Rewards® Visa: ¡Hasta 7.5% de reembolso!

¿Te encanta Kohl's? ¡Esta tarjeta Visa también te permite ganar recompensas fuera de la tienda! Descubre cómo aprovechar al máximo los descuentos y evitar trampas ocultas.

Continúe Leyendo

Revisión de Capital One Guaranteed Mastercard: ¡Una opción definitiva (y buena)!

La última puerta en abrirse podría ser la Capital One Guaranteed Mastercard, que ciertamente puede ser su herramienta para reconstruir su crédito.

Continúe LeyendoTambién te puede interesar

¿Te interesa solicitar la tarjeta Destiny Mastercard® Cashback Rewards? ¡No busques más!

Continúe Leyendo

La gente está priorizando el pago de la deuda de préstamos estudiantiles sobre el ahorro.

Muchos solicitantes de préstamos estudiantiles han postergado sus planes de ahorro mientras se concentran en pagar sus deudas. Obtenga más información aquí.

Continúe Leyendo