Loans

Review PenFed Personal Loan

PenFed Credit Union Personal Loan Review: Is It the Right Choice for You?

Anuncios

PenFed Credit Union Personal Loans: Fast Cash with No Hassles!

Covering home improvement expenses or consolidating debt has never been easier. PenFed Credit Union is here to assist you! In this comprehensive review of PenFed Credit Union Personal Loans, you’ll find all the information you need.

You’ll understand how this personal loan works, how much you can borrow, and decide if it fits your needs. Do you want to know more? Keep reading!

-APR: Variable APR of 7.74% to 17.99%;

-Loan Purpose: Debt consolidation, home improvement, transportation, medical & dental, life and events;

-Loan Amounts: From $600 to $50,000;

-Credit Needed: 690 or higher;

-Origination Fee: It doesn’t charge an origination fee;

-Late Fee: You’ll be charged a fee after some days from your repayment due date if you don’t make your payments;

-Early Payoff Penalty: It doesn’t charge an early payoff penalty.

PenFed Credit Union: A Popular Unsecured Personal Loan Option for All

PenFed Credit Union is renowned for its unsecured personal loan options, initially designed for active military members, veterans, and their families. However, the membership is not exclusive to the military, as anyone who meets the requirements can join for free.

With PenFed Credit Union Personal Loans, borrowers have the flexibility to borrow anywhere from $600 to $50,000, and they can enjoy terms of up to 60 months. The best part? There are no early payoff penalties, allowing borrowers to repay their loans at their own pace.

The versatility of this loan makes it suitable for various purposes, ranging from covering transportation expenses to financing home improvements, healthcare costs, and much more.

When it comes to offers, PenFed Personal Loan stands out for its transparency. Borrowers can expect competitive rates without any origination fees or hidden charges.

To help borrowers make informed decisions, PenFed Credit Union offers the option to pre-qualify, providing a clearer understanding of the loan terms and repayment amounts. Additionally, they provide a user-friendly app that allows borrowers to track their loan progress and access 24/7 customer service.

Serás redirigido a otro sitio

Is PenFed Credit Union Personal Loan a Good Choice?

PenFed Credit Union Personal Loan can prove to be a valuable resource in times of financial need. Consider the following pros and cons to evaluate its suitability for your specific circumstances.

Pros

- Transparent: There are no hidden fees involved.

- Pre-Qualification: The online application allows for pre-qualification, giving you an idea of your eligibility.

- No Prepayment or Origination Fees: You don’t need to worry about additional fees when it comes to prepayment or origination.

Cons

- Limited Payment Options: There are not many choices to select from or adjust payment dates.

- Membership Requirement: To apply for the PenFed Credit Union Personal Loan, you must be a member of the credit union.

Does PenFed Credit Union Personal Loan Consider Credit Scores?

Yes, PenFed Credit Union Personal Loan does consider credit scores. They require applicants to have a credit score of 600 or higher in order to borrow from them.

Interested in PenFed Credit Union Personal Loans? We’re here to assist you!

Did you find our PenFed Credit Union Personal Loans review helpful? It can be a solution for unexpected expenses that arise from time to time.

Discover how to apply for a loan with PenFed Credit Union and secure the cash you need. Keep reading our post below for all the details.

Tendencias

See how to apply for the LightStream Personal Loan

Have you already chosen the Lightstream Personal Loan, but do not know how to apply for the loan? Click this article to find out how!

Continúe Leyendo

Review of the Premier Bankcard® Credit Card

A good credit card offers a good service to every client. See how to apply for Premier Bankcard, an incredible card in EUA!

Continúe Leyendo

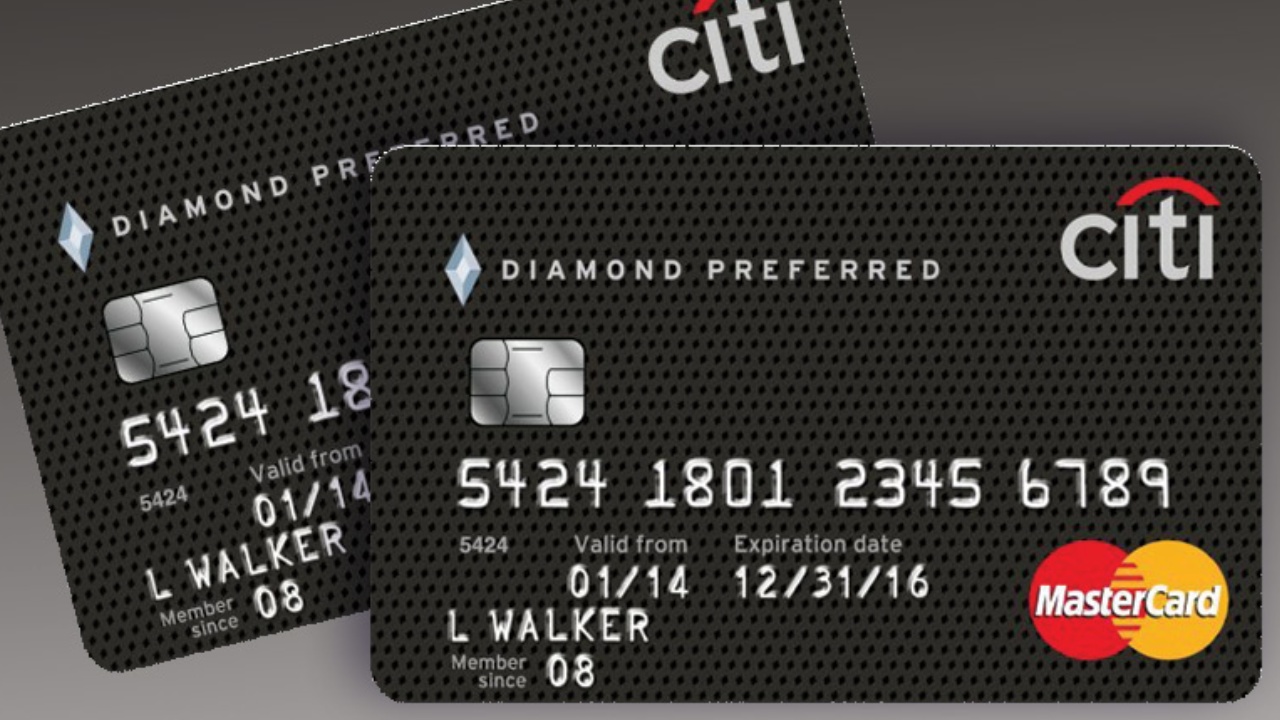

Review of the Citi Diamond Preferred® credit card

Read a review of the advantages, disadvantages and requirements for applying for your Citi Diamond credit card.

Continúe LeyendoTambién te puede interesar

Wells Fargo Bilt Mastercard: Earn Rewards on Rent and More!

Rent is expensive—but with the Wells Fargo Bilt Mastercard, you earn points for every dollar without extra fees. Learn more!

Continúe Leyendo

Review of the BMO Cashback Business Mastercard® credit card

Your business deserves the best credit card. Discover everything the BMO Cashback Business Mastercard has to offer.

Continúe Leyendo

10 tips on how to use credit cards to your advantage!

Learn how to use credit cards to your advantage, and enjoy the benefits they can provide you. Read these 10 tips and use your cards wisely.

Continúe Leyendo