Tarjetas de crédito

Tarjeta Wells Fargo Active Cash®: Su solución sencilla e ilimitada de devolución de efectivo

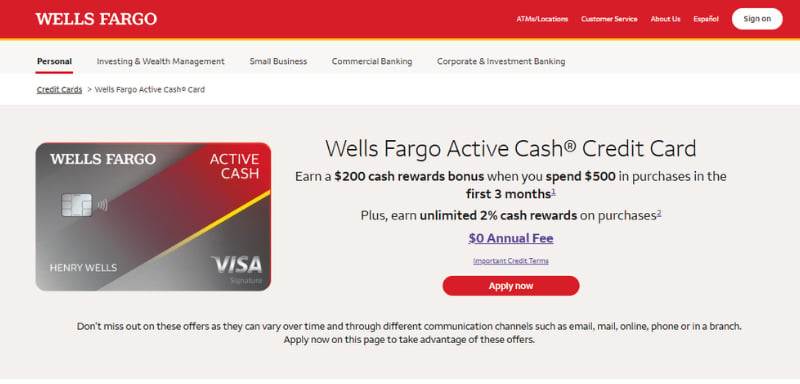

¿Quién necesita categorías de recompensas complejas? Con la Tarjeta Wells Fargo Active Cash®, obtendrás 2% de reembolso en efectivo en cada compra, sin límites ni estrés. ¡Además, un bono de bienvenida de $200 lo hace aún más atractivo!

Anuncios

¡Gana 2% de reembolso en todo! Sin trucos, ¡solo recompensas!

¿Buscas una tarjeta de crédito que te permita ganar recompensas sin esfuerzo? Tarjeta Wells Fargo Active Cash® Es un sueño hecho realidad para aquellos que quieren un Reembolso directo e ilimitado de 2% en cada compra.

Sin categorías rotativas, requisitos de activación ni límites de gasto, esta tarjeta simplifica las cosas. Además, con Sin cuota anual y un atractivo bono de bienvenidaEs una opción de primer nivel para el gasto diario.

Serás redirigido a otro sitio

Características principales de la tarjeta Wells Fargo Active Cash®

| Ventajas |

| ✔ Reembolso ilimitado de 2% en cada compra |

| ✔ Bono de registro de $200 después de gastar $500 en los primeros 3 meses |

| ✔ 0% Tasa de interés introductoria (APR) por 12 meses en compras y transferencias de saldo |

| Contras |

| ✖ Tarifa por transacción extranjera 3% |

| ✖ No hay categorías de recompensa elevadas |

Tarjeta Wells Fargo Active Cash®: resumen

| Característica | Detalles |

|---|---|

| Cuota anual | $0 |

| Límite de crédito | Basado en la solvencia |

| Tasa de interés anual (APR) | 0% APR introductorio por 12 meses, luego 19.24%-29.24% |

| Bono de bienvenida | $200 recompensas en efectivo después de gastar $500 en 3 meses |

| Recompensas | Reembolso ilimitado de 2% en todas las compras |

| Beneficios | Protección de teléfonos celulares, cobertura de responsabilidad por fraude |

| Se necesita puntaje de crédito | Bueno a excelente |

Por qué esta tarjeta de devolución de efectivo sin cargo merece un lugar en tu billetera

El Tarjeta Wells Fargo Active Cash® Está diseñado para simplicidad y máximo potencial de devolución de efectivo.

A diferencia de otras tarjetas de recompensas que te obligan a realizar un seguimiento categorías de gastos o bonificaciones trimestrales, este te da un piso 2% reembolso en efectivo en todo—No es necesario pensar dos veces en dónde y cómo gastas.

Wells Fargo, una institución financiera de confianza, respalda esta tarjeta con fuertes ventajas, a generoso bono de bienvenida, y un Período de introducción APR 0%, lo que lo convierte en una opción fantástica tanto para las compras diarias como para las compras de gran valor.

¿Quién debería obtener la tarjeta Wells Fargo Active Cash®?

No todas las tarjetas de crédito funcionan para todo tipo de gastadores, por lo que es fundamental comprobar si esta se ajusta a sus necesidades.

Si prefieres una Estructura sencilla y de alta recompensa Sin preocuparse por activar bonificaciones o cambiar patrones de gasto, esta tarjeta es una excelente opción.

Además, es perfecto para aquellos que desean maximizar sus recompensas sin tener que pagar una tarifa anual.

Esta tarjeta es una ajuste ideal si usted:

- ¿Quieres recompensas fáciles e ilimitadas? – Obtenga 2% de reembolso en efectivo sin seguimiento de categorías.

- Prefiero una tarjeta sin cuota anual – Guarde más de sus recompensas en su bolsillo.

- ¿Necesita un período de APR introductorio? – 0% intereses por 12 meses en compras y transferencias de saldos.

Dicho esto, si viajar internacionalmente o prefieres una tarjeta con categorías de bonificaciónQuizás quieras explorar otras opciones.

Elegibilidad de Active Cash®: ¿Califica usted?

Si está considerando solicitar la Tarjeta Wells Fargo Active Cash®Es importante comprender los criterios de aprobación.

Si bien cada solicitud se evalúa individualmente, cumplir con ciertos requisitos financieros mejorará significativamente sus posibilidades. Analicemos los puntos esenciales.

Requisitos de aprobación típicos:

- Una puntuación de crédito de buena a excelente (670 o superior).

- Un ingreso estable para demostrar responsabilidad financiera.

- Un historial crediticio limpio para cumplir con los estándares de suscripción de Wells Fargo.

Consejos para mejorar sus posibilidades de aprobación

- Verifique su puntuación crediticia para garantizar que cumple el umbral.

- Reduzca su utilización del crédito mediante el pago de los saldos existentes.

- Evite pagos atrasados en los meses previos a su solicitud.

Guía paso a paso para obtener su tarjeta Wells Fargo Active Cash®

Solicitando la Tarjeta Wells Fargo Active Cash® Es un proceso rápido y sencillo.

Para mejorar sus posibilidades de aprobación, asegúrese de cumplir con los requisitos básicos y tener lista su información financiera. Siga estos pasos para una solicitud sin complicaciones.

- Visita el sitio web de Wells Fargo – Localice la página de la aplicación Active Cash®.

- Complete sus datos – Proporcione su información personal y financiera.

- Revisar los términos – Comprenda la Tasa de Porcentaje Anual (APR), las recompensas y los cargos antes de continuar.

- Envíe su solicitud – Wells Fargo realizará una verificación de crédito y evaluará la elegibilidad.

- Esperar la aprobación – Si se aprueba, recibirás los detalles de tu tarjeta en unos días.

- Activa y empieza a ganar – ¡Usa tu tarjeta y disfruta sin esfuerzo del reembolso en efectivo de 2%!

Cómo funciona su límite de crédito y cómo obtener más

Su límite de crédito Es la cantidad máxima que puedes cargar a tu tarjeta antes de tener que pagarla.

Wells Fargo establece su límite inicial basándose en factores como puntuación crediticia, ingresos e historial financiero.

Si realiza pagos puntuales de manera constante y mantiene saldos bajos, puede calificar para una aumento del límite de crédito Con el tiempo, le brindará más flexibilidad financiera.

¿Quieres un? límite de crédito más altoSigue estos consejos:

- Realizar pagos puntuales – Demuestre a los prestamistas que puede gestionar el crédito de manera responsable.

- Utilice su tarjeta con frecuencia – Pero mantenga baja su tasa de utilización.

- Solicitar un aumento del límite de crédito – Si tiene un buen historial crediticio, podría calificar para más crédito.

Y no lo olvides…Pagando su saldo total cada mes ¡Le ayuda a evitar cargos por intereses!

Cómo mantenerse al tanto de sus gastos y recompensas

Para sacar el máximo provecho de su Tarjeta Wells Fargo Active Cash®Es esencial mantenerse al tanto de sus gastos y recompensas.

Wells Fargo ofrece herramientas fáciles de usar como Banca móvil, pagos automáticos de facturas y alertas de fraude para que la gestión de cuentas sea fácil y segura.

- Aplicación móvil fácil de usar – Realice un seguimiento de los gastos, verifique los saldos y canjee recompensas.

- Servicio al cliente 24/7 – Obtenga asistencia por teléfono o chat en cualquier momento.

- Características de seguridad – Monitoreo de fraude, alertas en tiempo real y protección de responsabilidad cero.

Active Cash® vs. Bilt Mastercard: ¿Cuál gana?

A la hora de elegir una tarjeta de crédito, siempre es una buena idea comparar opciones. Tarjeta Wells Fargo Active Cash® y el Tarjeta Mastercard de Bilt satisfacen diferentes necesidades financieras, por lo que es importante comprender cuál se adapta mejor a su estilo de vida.

Si estás buscando una tarjeta de devolución de efectivo sencilla, el Tarjeta Active Cash® Es difícil de superar con su reembolso ilimitado de 2% en cada compra.

Por otra parte, la Tarjeta Mastercard de Bilt es una opción única para los inquilinos que desean Gane recompensas en los pagos de alquiler sin cargos adicionales, junto con sólidos beneficios de viaje y comidas.

| Característica | Efectivo activo de Wells Fargo® | Tarjeta Mastercard Wells Fargo Bilt |

|---|---|---|

| Cuota anual | $0 | $0 |

| Tasa de porcentaje anual introductoria (APR) | 0% por 12 meses | Ninguno |

| Tasa de recompensas | 2% en todo | 1X en alquiler, 2X en viajes, 3X en comidas |

| Tarifas por transacciones en el extranjero | Sí (3%) | No |

| Mejor para | Reembolso simple | Recompensas de alquiler y puntos de viaje |

¿Cuál deberías elegir?

- Para reembolsos de efectivo ilimitados, elegir Efectivo activo®.

- Para inquilinos que buscan recompensas, ve con el Tarjeta Mastercard de Bilt.

👉 ¿Quieres más detalles sobre la tarjeta Bilt Mastercard? Consulte nuestra revisión en profundidad aquí.

Reseña de la tarjeta Wells Fargo Bilt Mastercard

El alquiler es caro, pero con la tarjeta Wells Fargo Bilt Mastercard, ganas puntos por cada dólar sin cargos adicionales. ¡Más información!

Reflexiones finales: ¿Es la tarjeta Active Cash® una elección inteligente?

El Tarjeta Wells Fargo Active Cash® es Una de las mejores tarjetas de crédito con devolución de efectivo y tarifa plana Disponible hoy. Con reembolso ilimitado de 2%, a Bono de bienvenida de $200, y sin cuota anual, es una excelente opción para las compras diarias.

Sin embargo, si usted viajar al extranjero con frecuenciaQuizás quieras una tarjeta con Sin comisiones por transacciones en el extranjero.

🚀 ¿Estás pensando en postularte? ¡Asegúrate de cumplir con los requisitos crediticios y comienza a ganar 2% de reembolso en efectivo en todo hoy mismo!

Tendencias

Préstamos estudiantiles Earnest: Obtenga más información

¡Descubre más sobre Earnest Student Loans, la increíble compañía de préstamos estudiantiles! Haz clic en este artículo para saber más.

Continúe Leyendo

Reseña de la tarjeta prepaga Mastercard de Koho: una plataforma moderna y confiable

Una herramienta financiera moderna como la tarjeta prepago Koho Mastercard merece toda tu atención. Para simplificarlo todo, ¡aquí tienes nuestra reseña!

Continúe LeyendoTambién te puede interesar

Membresías en Costco: ¡La forma más inteligente de ahorrar en grande!

¿Valen la pena las membresías en Costco? ¡Descubre cómo ahorrar al por mayor, obtener reembolsos y beneficios exclusivos que te ayudan a ahorrar más cada año!

Continúe Leyendo

Indigo™ Mastercard®: Una tarjeta que genera crédito para quienes más la necesitan

¿Mal crédito? ¡No te preocupes! La tarjeta Mastercard Indigo es tu segunda oportunidad para alcanzar la libertad financiera: sin depósito y con aprobación fácil.

Continúe Leyendo

Préstamo estudiantil creíble: Más información

¡Descubre más sobre esta empresa que te facilitará y agilizará la búsqueda de préstamos estudiantiles! Prueba Credible.

Continúe Leyendo