Perfect! We've found a loan that fits many different financial scenários – it might suit yours!

Do you need a fast loan? Try it with Discover Personal Loan!

Advertisement

What have you been thinking lately? Do you have any plans for the future? If you do have them, and have already decided on what they are, the Discover Personal Loan can help. If we got your interest, keep reading our article!

First, we must show you why Discover Personal Loan is a great choice by telling you come of their best qualities.

You will remain in the same website

Who can get a loan with Discover® Personal Loans

You already know a lot more than you did in the beginning of this article, or well, before you even started to read it, so now we will try our best to explain who can apply for a loan and in what conditions you will not be able to do it!

Can people with bad credit get a loan? What about no credit at all?

Score credit is an essential part on getting a loan, you may ask “Why is that?”, well, credit score is basically a score where the lenders can see how reliable to repay the loan you are. Let us show with an example: You get a loan for a car, and you repay it on time until the end, that will make your credit go higher. But if you constantly miss payment day or don’t even sometimes pay, that will hurt your credit score. To get a loan with Discover® Personal Loans, you need to have at last 660 credit score, which is considered fair, if you have under it, you can’t apply.

People who need money really fast

Oh? You need your money really fast? It’s okay, Discover® Personal Loans has a very fast funding, if your applications has 0 spelling errors, the loan is funded on a weekday night, and if the funds are sent electronically, then you can have the money in the next business day. If you do not meet these terms, then I’m afraid your loan will take some more time, but it will still be pretty fast.

What if I can’t pay the initial deposit?

With Discover® Personal Loans, or any other company, you really need to pay an initial deposit. The initial deposit is based on how high your loan is, so that your repayment isn’t too high and impossible to pay, but if you have a small loan, it shouldn’t be necessary, or really high.

Is it really safe?

Yes! Discover® Personal Loans has a lot of protocols for safety, especially working online, it’s really common to get scammed or tricked, so Discover® Personal Loans will make sure you don’t. The only people to know your information will be their employees and, of course, the lender.

Know more about LendingPoint Personal Loan

Have you not liked this company? It’s okay, there is more fish in the sea, you see? LendingPoint Personal Loan is an amazing choice if you wish to get a personal loan. They have quick services, fast funding and their website is also safe! If you wish to know more, do not hesitate to click on the link below so that you can get to know different companies.

Trending Topics

Review of the Capital One Platinum® credit card

See an important summary about the Capital One Platinum credit card and everything it can offer its users.

Keep Reading

Review of the Fortiva Mastercard® credit card

Find out in this article what are the requirements, advantages and disadvantages of the Fortiva Mastercard credit card!

Keep Reading

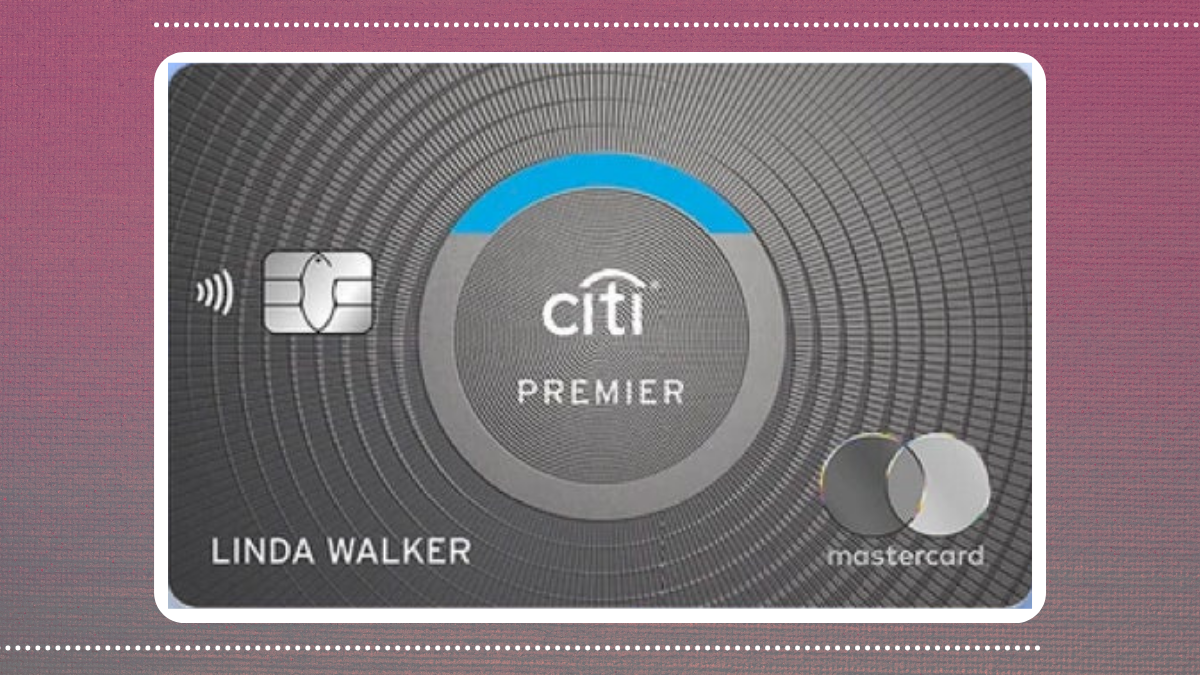

Citi Premier® review: is it worth it?

If you're looking for a travel credit card with excellent benefits, you should read this Citi Premier® review. This is the one, keep reading!

Keep ReadingYou may also like

Apply for LendingPoint Personal Loan

Learn now the step by step on how to apply for a loan with LendingPoint Personal Loan! One of the best companies for personal loans.

Keep Reading

Discover it® Secured Credit Card: Build Your Credit While Earning Rewards

Boost your credit score the smart way! The Discover it® Secured Credit Card gives you cashback, no annual fee, and a shot at an upgrade.

Keep Reading

Koho Prepaid Mastercard Review: Modern and Reliable Builder

A modern financial tool like the Koho Prepaid Mastercard deserves your full attention. To make everything simpler, here's our review!

Keep Reading