Great news! We've found the perfect personal loan for you – Next Day Personal Loan.

Loan amounts ranging from $100 to $40,000 – quick application and quick funding!

Advertisement

If you’re considering other options, such as a zero percent APR card, we recommend applying for a Next Day Personal Loan instead. Take advantage of this opportunity and secure the funds you need. Apply now and enjoy the benefits of a hassle-free loan experience.

If you're looking for a loan that provides convenience and flexibility, Next Day Personal Loan is ideal. Whether you need funds for education, a vacation, or daily expenses, this loan has got you covered. Don't miss out on this great opportunity! Here are some of the advantages of applying for a Next Day Personal Loan:

You will remain in the same website

Repaying loans from Next Day Personal Loan depends on the specific lending partner you work with.

Each lender may have different repayment terms based on factors such as the borrowed amount, credit score, and overall financial situation.

It is important to communicate directly with the lending partner to understand the repayment schedule and requirements.

When it comes to receiving funds, if your loan application is approved by one of Next Day Personal Loan’s lending partners, you can expect to receive your funds as soon as the next business day.

However, the processing time may vary depending on the lender, and approval is necessary before funds can be disbursed.

Next Day Personal Loan operates as a marketplace, connecting borrowers with a network of lending partners across the country.

By filling out a form on their website, you can easily apply for a loan and find the lending partner that best suits your financial needs.

Comparing loans to zero percent APR credit cards, there are notable differences.

With a loan, the borrower receives the full loan amount upfront, while a zero percent APR credit card provides a line of credit that can be accessed as needed.

Loans typically have fixed interest rates, whereas zero percent APR cards have an introductory period with no interest, but the interest rate may increase afterward.

Personal loans are commonly used for larger purchases like cars or homes, while zero percent APR cards are often used for smaller expenses or consolidating credit card debt.

Also, loans also tend to have longer repayment terms compared to the introductory period of zero percent APR cards, which typically lasts for 12 to 18 months.

If you’re facing a financial challenge and need extra cash, Next Day Personal Loan offers an easy application process to connect borrowers with lenders.

Apply now to explore your options and find the financial assistance you need.

Trending Topics

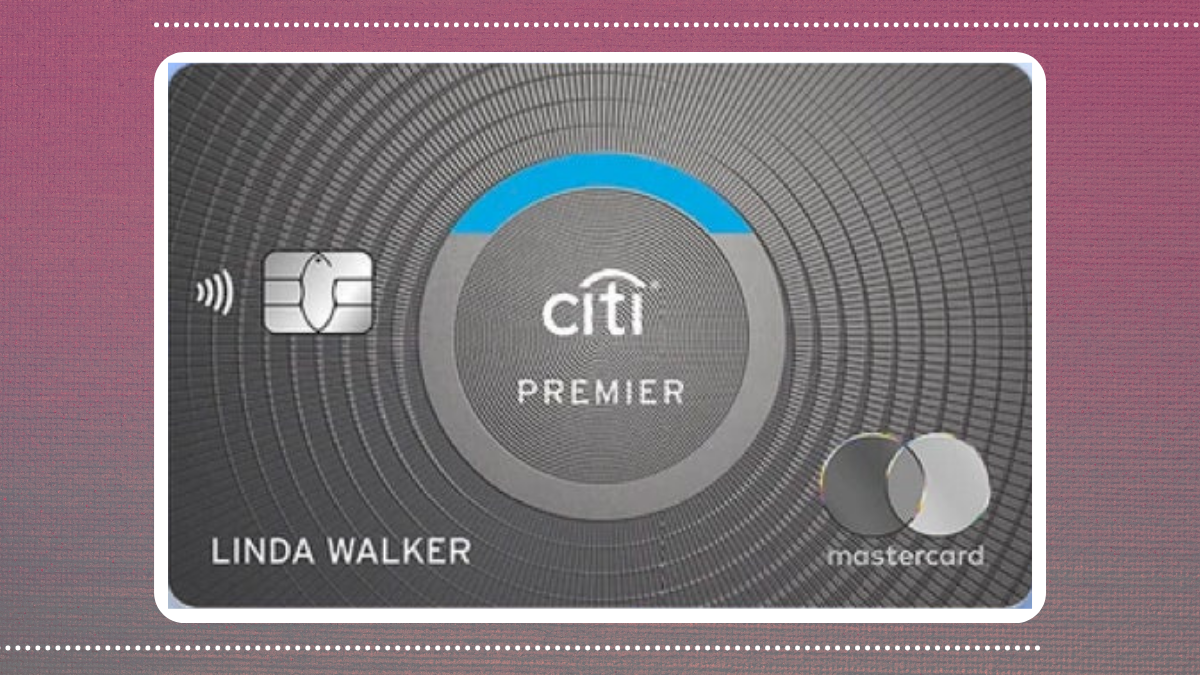

Citi Premier® review: is it worth it?

If you're looking for a travel credit card with excellent benefits, you should read this Citi Premier® review. This is the one, keep reading!

Keep Reading

Lightstream Personal Loan: Learn More

Learn about the advantages and disadvantages of taking out a loan with Lightstream Personal Loan, and much more!

Keep ReadingYou may also like

Review of the Applied Bank Gold Preferred Secured Visa® Credit Card

Discover now the advantages and disadvantages of the Applied Bank Gold Preferred Secured Visa credit card!

Keep Reading

785 credit score is an indicator of good or bad financial health?

If you have a 785 credit score you might be feeling very proud. But is it good or bad? This article will tell you more about this score.

Keep Reading