Credit Cards

Wells Fargo Active Cash® Card: Your Simple, Unlimited Cash Back Solution

Who needs complicated rewards categories? With the Wells Fargo Active Cash® Card, you’ll earn 2% cash back on every purchase—no limits, no stress. Plus, a $200 sign-up bonus makes it even sweeter!

Advertisement

Earn 2% Cash Back on Everything – No Gimmicks, Just Rewards!

Looking for a credit card that makes earning rewards effortless? The Wells Fargo Active Cash® Card is a dream come true for those who want a straightforward, unlimited 2% cash back on every purchase.

With no rotating categories, activation requirements, or spending caps, this card keeps things simple. Plus, with no annual fee and an attractive welcome bonus, it’s a top-tier choice for everyday spending.

Key Features of the Wells Fargo Active Cash® Card

| Pros |

| ✔ Unlimited 2% cash back on every purchase |

| ✔ $200 sign-up bonus after spending $500 in the first 3 months |

| ✔ 0% intro APR for 12 months on purchases and balance transfers |

| Cons |

| ✖ 3% foreign transaction fee |

| ✖ No elevated reward categories |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive marketing messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Wells Fargo Active Cash® Card – At a Glance

| Feature | Details |

|---|---|

| Annual Fee | $0 |

| Credit Limit | Based on creditworthiness |

| APR (Interest Rate) | 0% intro APR for 12 months, then 19.24%-29.24% |

| Welcome Bonus | $200 cash rewards after spending $500 in 3 months |

| Rewards | Unlimited 2% cash back on all purchases |

| Perks | Cell phone protection, fraud liability coverage |

| Credit Score Needed | Good to excellent |

Why This No-Fee Cash Back Card Deserves a Spot in Your Wallet

The Wells Fargo Active Cash® Card is built for simplicity and maximum cash-back potential.

Unlike other rewards cards that force you to track spending categories or quarterly bonuses, this one gives you a flat 2% cash back on everything—no need to think twice about where or how you spend.

Wells Fargo, a trusted financial institution, backs this card with strong perks, a generous welcome bonus, and a 0% intro APR period, making it a fantastic option for both everyday purchases and big-ticket buys.

Who Should Get the Wells Fargo Active Cash® Card?

Not all credit cards work for every type of spender, so it’s essential to see if this one aligns with your needs.

If you prefer a straightforward, high-reward structure without worrying about activating bonuses or shifting spending patterns, this card is a great choice.

Plus, it’s perfect for those who want to maximize rewards without dealing with an annual fee.

This card is an ideal fit if you:

- Want easy, unlimited rewards – Earn 2% cash back without tracking categories.

- Prefer a no-annual-fee card – Keep more of your rewards in your pocket.

- Need an intro APR period – 0% interest for 12 months on purchases and balance transfers.

That said, if you travel internationally or prefer a card with bonus categories, you might want to explore other options.

Active Cash® Eligibility: Do You Qualify?

If you’re considering applying for the Wells Fargo Active Cash® Card, it’s important to understand the approval criteria.

While every application is evaluated individually, meeting certain financial benchmarks will significantly improve your chances. Let’s break down the essentials.

Typical approval requirements:

- A good to excellent credit score (670 or higher).

- A steady income to show financial responsibility.

- A clean credit history to meet Wells Fargo’s underwriting standards.

Tips to Improve Your Chances of Approval

- Check your credit score to ensure it meets the threshold.

- Lower your credit utilization by paying down existing balances.

- Avoid late payments in the months leading up to your application.

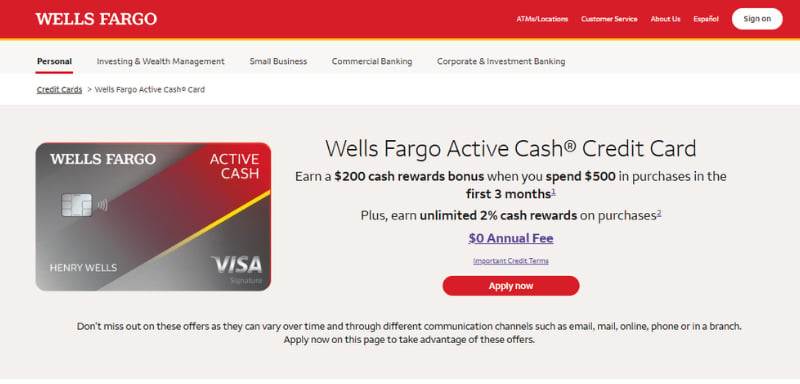

Step-by-Step Guide to Getting Your Wells Fargo Active Cash® Card

Applying for the Wells Fargo Active Cash® Card is a quick and easy process.

To improve your approval chances, make sure you meet the basic requirements and have your financial information ready. Follow these steps for a hassle-free application.

- Go to the Wells Fargo website – Locate the Active Cash® application page.

- Fill in your details – Provide your personal and financial information.

- Review the terms – Understand the APR, rewards, and any fees before proceeding.

- Submit your application – Wells Fargo will run a credit check and assess eligibility.

- Wait for approval – If approved, you’ll get your card details within days.

- Activate & start earning – Use your card and enjoy effortless 2% cash back!

How Your Credit Limit Works – And How to Get More

Your credit limit is the maximum amount you can charge to your card before needing to pay it off.

Wells Fargo sets your initial limit based on factors like credit score, income, and financial history.

By consistently making on-time payments and keeping balances low, you may qualify for a credit limit increase over time, giving you more financial flexibility.

Want a higher credit limit? Follow these tips:

- Make timely payments – Show lenders you can manage credit responsibly.

- Use your card frequently – But keep your utilization rate low.

- Request a credit limit increase – If you have a good track record, you might qualify for more credit.

And don’t forget—paying your balance in full each month helps you avoid interest charges!

How to Stay on Top of Your Spending and Rewards

To get the most out of your Wells Fargo Active Cash® Card, it’s essential to stay on top of your spending and rewards.

Wells Fargo offers user-friendly tools like mobile banking, automatic bill payments, and fraud alerts to make account management easy and secure.

- User-friendly mobile app – Track spending, check balances, and redeem rewards.

- 24/7 customer service – Get assistance via phone or chat anytime.

- Security features – Fraud monitoring, real-time alerts, and zero liability protection.

Active Cash® vs. Bilt Mastercard – Which Wins?

When it comes to choosing a credit card, it’s always a good idea to compare options. The Wells Fargo Active Cash® Card and the Bilt Mastercard serve different financial needs, making it important to understand which one aligns best with your lifestyle.

If you’re looking for a straightforward cash-back card, the Active Cash® Card is hard to beat with its unlimited 2% cash back on every purchase.

On the other hand, the Bilt Mastercard is a unique option for renters who want to earn rewards on rent payments without extra fees, along with solid travel and dining perks.

| Feature | Wells Fargo Active Cash® | Wells Fargo Bilt Mastercard |

|---|---|---|

| Annual Fee | $0 | $0 |

| Intro APR | 0% for 12 months | None |

| Rewards Rate | 2% on everything | 1X on rent, 2X on travel, 3X on dining |

| Foreign Transaction Fees | Yes (3%) | No |

| Best For | Simple cash back | Rent rewards and travel points |

Which One Should You Choose?

- For unlimited cash back, pick Active Cash®.

- For renters wanting rewards, go with the Bilt Mastercard.

👉 Want more details on the Bilt Mastercard? Check out our in-depth review here.

Wells Fargo Bilt Mastercard review

Rent is expensive—but with the Wells Fargo Bilt Mastercard, you earn points for every dollar without extra fees. Learn more!

Final Thoughts: Is the Active Cash® Card a Smart Pick?

The Wells Fargo Active Cash® Card is one of the best flat-rate cash-back credit cards available today. With unlimited 2% cash back, a $200 welcome bonus, and no annual fee, it’s an excellent choice for everyday purchases.

However, if you travel abroad frequently, you might want a card with no foreign transaction fees.

🚀 Thinking of applying? Make sure you meet the credit qualifications and start earning 2% cash back on everything today!

Trending Topics

5 ways to improve your credit score: get these easy tips

If you're looking for ways to improve your credit score, you're in the right place. This post has the perfect tips to build an excellent one!

Keep Reading

People are prioritizing student loan debt payment over savings

Many student loan borrowers have put their savings plans on the backburner while they focus on paying down their debt. Learn more here.

Keep Reading

Rebuilding Credit? Meet the Milestone Mastercard – No Deposit Required!

Bad credit? No worries! The Milestone Mastercard helps you rebuild your score with no security deposit. Find out how to apply now!

Keep ReadingYou may also like

See how to apply for the LightStream Personal Loan

Have you already chosen the Lightstream Personal Loan, but do not know how to apply for the loan? Click this article to find out how!

Keep Reading

Review of the Citi Diamond Preferred® credit card

Read a review of the advantages, disadvantages and requirements for applying for your Citi Diamond credit card.

Keep Reading