Credit Cards

See how to request the Costco Anywhere Visa® Credit Card

Wondering how to apply for the Costco Anywhere Visa credit card? Then read on for our full tutorial with lots of extra tips and a final card review!

Advertisement

Find out once and for all how to apply for your Costco Anywhere Visa credit card that offers incredible cashback and rewards

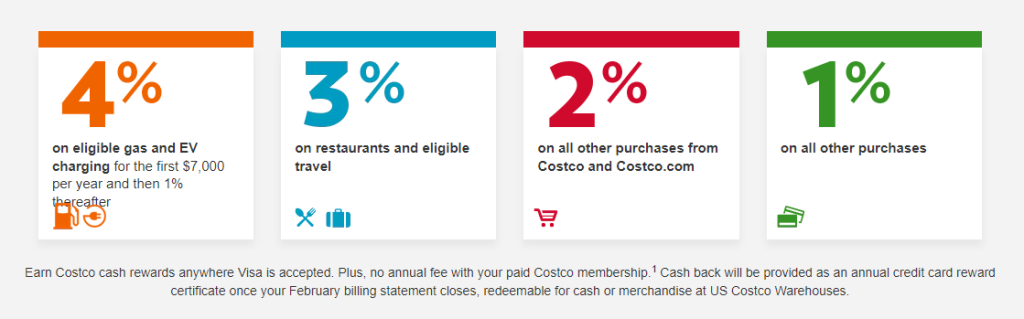

If you’ve come this far, it’s because you’re very interested in ordering your Costco Anywhere Visa credit card, right? We came to let you know that the wait for that moment is over, and we’re going to tell you how you can receive additional Cashback on purchases from affiliated stores or even common purchases in traditional non-affiliated stores.

After all, we are talking about a credit card that is very easy to apply for here. And since we already told you what the requirements are, now you know if you meet all of them and you can apply for yours and be approved quickly. Because this card offers exclusive benefits and is highly sought after by many people.

Finally, without further ado, we are going to tell you right now how you can order yours and it is important to know that the entire process is done online. This means that you don’t have to go to an agency or face queues to ask for your card. For that, keep reading this article and you will be able to learn how to order yours quickly.

How to get your Costco Anywhere Visa credit card?

Now we come to that part of the article that you’ve been waiting for the most, a moment where we will teach you how to apply for your Costco Anywhere Visa credit card. If so, you’ve already taken a look at the requirements, haven’t you? So, you probably already know that the first one is to be a Costco member. If you have already completed this part, just access the website and check how to apply for your card. But we will tell you step by step.

First, you will need to fill out a form where you will provide your personal and financial information. In addition, you must be 18 years of age or older to apply for your card. Afterward, you will need to present personal documents, as well as proof of residence and proof of income. In this case, the proof of residence must be in your name and dated up to 3 months before.

And as we said in the requirements part, this card may require you to have a higher monthly financial income. This is because the bank needs to understand that you have the financial capacity to pay the installments. And therefore, one of the requirements may be that you present a valid proof of income with consistent information.

Finally, you will fill out the form and wait until The financial institution responsible for administering the credit card has responded. In case of approval, you will receive your card at the registered address and simply unlock it to start using it immediately. And finally being able to take advantage of the advantages that the card makes available to customers.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive marketing messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Is the Costco Anywhere Visa worth it?

As we said earlier, the purpose of this article is to offer you an honest opinion and it is worth noting that we are not affiliated with or associated with this credit card. Therefore, we want to ensure that you make an excellent financial choice. Therefore, it is important to know that this credit card can indeed be worthwhile for people who use it quite frequently to shop at Costco stores.

Also, if you are a person who drives a lot, you tend to frequent a lot of gas stations. Know that when using this credit card, you will also have additional advantages. However, it is worth remembering that the credit card has fees and, even if the annual fee is zero, you need to take into account the other fees involved in the process.

So the answer to the question if it’s worth it is that it depends on your need at the moment. If you are already used to using this credit card in partner or convenient stores, it can be an excellent alternative to gain additional benefits. However, if you do not use your credit card for these specific categories that we have mentioned here, this option may not be the most suitable and it is important that you know other options before applying.

How about trying the GO2bank™ Secured Visa Card credit card

If you are looking for another credit card option that might be interesting, we recommend the GO2bank™ Secured Visa Card. Click below and find out more about it.

Trending Topics

People are prioritizing student loan debt payment over savings

Many student loan borrowers have put their savings plans on the backburner while they focus on paying down their debt. Learn more here.

Keep ReadingYou may also like

Happy Money Personal Loan: Learn More

If you wish to know more about Happy Money Personal Loan, they you will know everything there is to know about this company here!

Keep Reading

See how to request the Mission Lane Visa® Credit Card

Learn once and for all how you can order your mission lane visa credit card online only! Continue reading and find out more.

Keep Reading