Credit Cards

See how to request the Premier Bankcard® Credit Card

We have a simple step-by-step guide to help you understand Premier Bankcard. Continue reading and you will be able to take advantage of a good offer that will make your financial life a lot easier. See it all!

Advertisement

Learn how to apply for a Premier Bankcard credit card even if you don’t have the best credit history

As we said earlier, this is an amazing credit card that doesn’t need a lot of credit history for you to have a good experience. To be approved for this financial product, things are quite simple.

This is an option for you to start building or rebuilding your credit history. Millions of American consumers across the country need that second chance or first chance to jump-start their financial lives. So, get moreover by checking out what we have to say about it.

As you continue reading, you will see a complete tutorial on how to have your registration analyzed by the bank. In addition, we will make sure that you finally get your credit card, with a very simple and didactic step-by-step.

Premier Bankcard requirements

To apply for this credit card, you must be at least 18 years old, have a stable income, reasonable credit history and visa / nationality documents / other things that prove your legal stay.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive marketing messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Learn how to obtain the Premier Bankcard online

Applying for this credit card is quite simple. The first thing you will need to do will be to visit the official First Premier bank website itself. It is also possible that you received an invitation. To do this, simply accept the offer.

There, you must fill out the complete registration form, which will require all the documents mentioned above, in addition to your ssn date of birth, email address, income and other information.

Then it will be time for you to review your filled in information and check the box to consent to receive communications from the company. They regularly sent out disclosures. Then confirm that you have read the terms.

If you really want to complete the registration, just click the confirm button on the page and get your credit report. It will depend a lot on the bank and the people who are working now. There are people who receive a response in 60 seconds, while others need 10 business days to receive their long-awaited response.

I requested it, but how will you evaluate First Premiere my credit?

Once you have applied for this credit card, know that the bank will evaluate your application. In addition to checking your monthly and annual earnings, they will also take a look at your consumer profile.

Yes, this credit card offers opportunities for people who are starting their credit history or want to rebuild that history. However, because it is a card that makes all of this possible, people think that any type of credit history can be approved.

This is not true. The bank does not make it fully explicit what the required credit history range is. However, you need to at least have an acceptable credit history. This is very important so that you can, yes, be approved.

But is it really a good card?

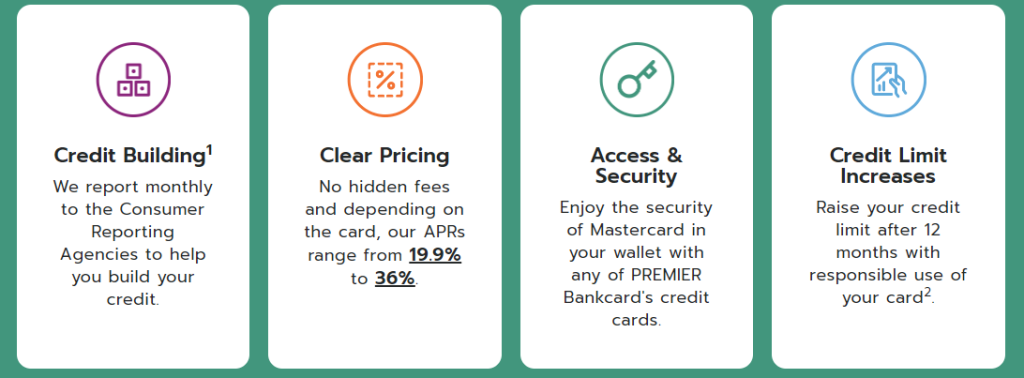

It’s time for us to give our final verdict so you can know whether or not the credit card is worth trying out. In our opinion, this is a very good credit card for anyone who wants to start building a credit history or wants to recover a credit history that was previously spoiled.

For this, it serves very well because it does not need a security deposit and offers support to people who really need to improve their history. But if you are already a person with a good credit history and have the possibility of having another card, it is not worth it.

Its fees are absurdly high and that is why it is a very expensive credit card compared to others on the market that can give you a better experience. Unless you’ve exhausted all other credit options, don’t opt for this card.

Credit cards with a guarantee deposit can be much more economical in terms of fees. Of course, everything will depend on your needs at the time, your credit history and several other things that are not for us to decide.

Anyway, this was our verdict and our review about the credit card, and we hope it helped you a lot to decide more about your financial life.

How about trying the Credit One Bank Platinum Visa?

The Credit One Bank Platinum Visa is another way to get a good credit card without needing an excellent credit history. As the fees for this card are a bit high, perhaps opting for another credit card would be a good idea.

Just click on the button below, so you can understand a little more about this card and everything it has to offer. We want to help you understand that you don’t necessarily need to depend on a single financial product to be successful.

Credit One Bank Platinum Visa

See how you can apply for Credit One Bank Platinum Visa – A lot of new features for you!

Trending Topics

See how to request the Capital One Quicksilver® Credit Card

Find out how you can apply for the Capital One Quicksilver credit card and find out if it's a good fit! See all about the card.

Keep Reading

See how to request the Credit One Bank Platinum Visa® Credit Card

Apply for your Credit One Bank Platinum Visa credit card. These are very good advantages to be offered! Keep reading to get it now.

Keep Reading

Apply for Ascent Loan

Learn how to apply for amazing student loans with Ascent! With Ascent you will get great deals and apply for it superfast

Keep ReadingYou may also like

Sallie Mae Student Loan: Learn More

Know more about Sallie Mae Student Loans and what to expect from this company! Get a student loan fast and easy.

Keep Reading

Review of the Amazon Prime Rewards® credit card

In this article you will be able to understand about the Amazon Prime Rewards credit card, and what advantages it offers!

Keep Reading