Credit Cards

Review of the Neo Financial® credit card

Enough of dealing with credit cards that only care about excessive fees and offer no benefits. At Neo Financial you don't pay an annual fee and you also have completely exclusive benefits. Keep reading!

Advertisement

Take advantage of the Neo Financial credit card with no annual fee – Learn more with the review!

Discover more about this Neo Financial credit card full of incredible benefits. We are doing a complete review with pros and cons about the theme. You will be able to experience every advantage that exists in this credit card and still know if it is really worth it in the end.

You will get cash rewards from all purchases you make using Neo card and thus you can have Cashback. There are no monthly fees, account maintenance costs or anything like that. Finally, know that we will do our best to let you know that you will have a good experience.

Keep reading and see the pros and cons of your Neo Financial Card right now! Enjoy the information.

Advantages of the Credit Card Neo Financial Card

The Neo Financial Card has some very interesting advantages. We’ll tell you each one of them, so you can find out if it’s worth it. Check it out:

- Cashback on purchases made with Neo: An incredible advantage is the fact that you can get incredible Cashback. Holders of this card should only use it when they need it and thus earn Cashback. Some places where this can happen are: Convenience stores, personal and online retail stores, gas stations, restaurants and others!

- More than 10,000 partner stores: Cashback has more than 10,000 partner stores in addition to offering an average of 5%. You will be able to redeem this automatically and of course cash out at any time.

- Some unique chances of 15% Cashback: Still talking about Cashback, I must point out that it is possible to reach the incredible 15%!

- No annual fee: You can try the card as you like, and you won’t have any kind of annual fee. Additionally, Neo Cash Back Rewards is available as a no-fee rewards program.

- The $25 bonus: You can get a $25 bonus as a new Neo card customer. This voucher is for a limited time, but can be used whenever and wherever you want without bureaucracy.

- Has a mobile app: The app is available for both Android and iOS. You can take advantage of the app and have control of your card in the palm of your hands.

- Pay your bills easily: Another thing that the card offers is the ease of paying any purchase with Apple or Google Pay.

- Neo savings account included: Finally, an unforgettable advantage is the Neo savings account that can be included in your rate. With it, you can earn interest on what you save and enjoy!

$0

$0

19.99% – 26.99%

22.99% – 28.99%

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Disadvantages of the Neo credit card

There are also some disadvantages of this credit card. Unfortunately, this is something that happens a lot. Read on to learn the once and for all disadvantages of the Neo Financial credit card:

- Stricter credit check: Previously, we’ve introduced some credit cards that allow you to have them without having to go through a very strict check. With this one, that doesn’t happen, you will need to have a good credit history and a good score.

- Savings account without features: Unfortunately, the savings account they offer is not very good. They don’t have as many features as other savings accounts that have been around for a long time. So if you’re joining the credit card for that possibility, it’s not worth it.

- There is no such thing as a good investment: If you are also looking for a credit card to invest in, it may not be the best place. The profit margin is not high and it turns out that you don’t have good options with low fees. Therefore, we do not advise you to acquire this type of account for this purpose.

Those are the only downsides that we consider with this credit card. His list is not very extensive, so we can say that he is largely worth it. Anyway, we’ll give the final verdict on the next page.

Know how to request the credit card Neo Financial

If you liked everything that we present to you, it’s time to click on the button below and go to the next page. There, in addition to teaching you how to apply for this credit card online, we’ll also give you the step-by-step process so that you can understand the final verdict.

Trending Topics

See how to request the First Access® Credit Card

First Access comes with an excellent proposal for those looking for a good credit history. Try it now and see how to adhere to your card!

Keep Reading

Review of the Upgrade Triple Cash Rewards® credit card

Find out in this article what are the advantages and disadvantages of the Upgrade Triple Cash Rewards credit card.

Keep ReadingYou may also like

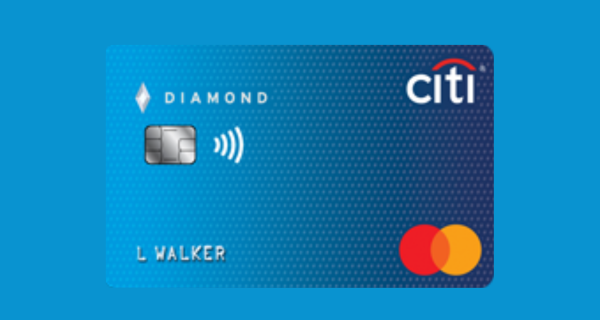

Review of the Citi Secured Mastercard® credit card

Find out all the advantages, disadvantages and requirements for applying for your Citi Secured Mastercard credit card!

Keep Reading