CA

Neo Secured Credit Card Review: For anyone? No, for you!

This is the place and time to unveil the Neo Secured Credit Card. See that a lot is hiding behind the few requirements to get yours!

Anuncios

Neo Secured Credit Card: No annual fee and real Cashback!

If having a Neo Secured Credit Card was ever a luxury for a few, I don’t recall! This credit tool knows you need something reliable you can count on. It’s more than just a convenience.

Among the available options, the Neo Secured Credit Card stands out as a solution focused on building or repairing credit. Is that what you’re looking for or need? Check it out.

| What’s great about this credit card 😍 | … but this could be better 👎 |

| Great credit builder | Requirement of a security deposit |

| Competitive interest rates | Credit limits based on the deposit |

| Ease of approval for those with low credit scores | Cashback may be limited and varies based on benefits, availability, and partner |

Yes, choosing the right card can be a challenge. However, the Neo Secured Credit Card makes this decision easier with its features aimed at strengthening credit.

Its fee structure and benefits are also designed to encourage responsible financial management. So, forget all the negative things you’ve heard about credit cards.

Know the card’s features: Nice to meet you, Neo Secured Credit Card!

Let’s get straight to the main point of the Neo Secured Credit Card. Here, we’re talking about Credit Building. It is ideal for those starting to improve their score or needing to improve it.

Secondly, let’s talk about security. Your deposit is secured, and the credit limit you can access is set. This works quite well for you when managing your financial life and is safe for your wallet.

That’s great, especially for you who are looking to build your credit. The Neo Secured Credit Card starts by releasing from $50. This way, you can improve your credit score responsibly.

Continuing on this topic, the Neo Secured Credit Card gives you access to tools to control your spending habits. Look closely at your spending averages and explore where your budget leaks are.

Lastly, the keyword to understand the Neo Secured Credit Card might be accessibility, thanks to the very low entry barrier and simplified approval. Take a look at each detail below:

| Credit score range to get this card | Ideal for low to medium credit scores. |

| What’s the card’s APR? | Competitive interest rates vary according to the user’s profile. |

| Does it charge an annual fee? | No, making it an even more appealing option. |

| And what about rewards? | Offers rewards on select purchases. |

| Is there any bonus for new cardholders? | Exclusive offers for new users. |

Serás redirigido a otro sitio

Neo Secured Credit Card pros VS cons: Unlock the benefits, avoid the traps

Before deciding, it’s crucial to weigh the pros and cons of the Neo Secured Credit Card. It offers an excellent opportunity to build your credit, but it’s important to understand its terms fully.

The best side of it:

- 🟢 No annual fee: The Neo Secured Credit Card stands out by offering no annual fee, making it a cost-effective choice for those seeking to build or rebuild their credit without incurring extra charges.

- 🟢 Easy approval: This card is designed with accessibility in mind, offering easy approval processes even for those with lower credit scores. It removes the barriers typically associated with securing a credit card, facilitating financial inclusion.

- 🟢 Contributes to credit building: By reporting your on-time payments to the credit bureaus, the Neo Secured Credit Card helps significantly build or improve your credit score, providing a foundation for better financial health in the future.

But keep an eye on these details:

- 🔴 Requires a security deposit: To obtain the Neo Secured Credit Card, applicants must provide a security deposit. This upfront payment secures the credit line and is a fundamental step towards card issuance, reflecting the secured nature of the card designed for credit building.

- 🔴 Credit limitations based on the deposit: The credit limit available on the Neo Secured Credit Card directly correlates with the size of the security deposit made by the cardholder. This approach ensures that the credit limit can be adjusted based on the individual’s capacity to deposit funds, offering flexibility in managing credit utilization.

Requirements to apply for the Neo Secured Credit Card: credit score and more

With the Neo Secured Credit Card, we’re discussing a secured credit card that is open to everyone. All you need to do is provide the required security funds.

This means that if you’re of legal age in your province or territory of residence within Canada, you already meet the very short list of Neo Secured Credit Card requirements.

Say «yes» to the card: How to apply for the Neo Secured Credit Card

Applying for the Neo Secured Credit Card is easy. You can submit your application online through the official website or app, following a straightforward process.

Just create your profile and choose a strong password. Then, you’ll fill out your information and provide your security deposit, and soon, a new card will be available in your wallet.

The app is available for both Android and iOS systems. So, you won’t have any trouble applying for your Neo Secured Credit Card directly from your phone. You can get to the official website using the following link.

Not ready to say yes? Give it a chance for the Home Trust Secured Visa Credit Card

When choosing a secured credit card, the Neo Secured Credit Card and the Home Trust Secured Visa Credit Card stand out as viable options.

On the one hand, the Neo Financial card presents a modern approach to financial security and flexibility, making it suitable for those looking to build or rebuild their credit history through digital technology.

On the other, the Home Trust Secured Visa, recognized as one of Canada’s top secured credit cards, offers global acceptance and no annual fee, with an option for a reduced interest rate for an annual fee.

Both cards require a security deposit and report activity to credit bureaus, aiding in developing a positive credit history.

Consider reading our complete review to learn more about the Home Trust Secured Visa Credit Card and its features and benefits.

This card promotes the building of a healthy credit history and provides the security and convenience modern consumers expect from a reliable credit solution. Read the complete review here.

Home Trust Secured Visa Credit Card review!

Meet the champion among secured cards. The Home Trust Secured Visa Credit Card is here to change the game!

Tendencias

What HCOL area means: it affects your life?

Learn the meaning of HCOL, so you can make better choices at life. This impacts every aspect of your life, so keep reading to learn about it.

Continúe Leyendo

Budget Christmas Spending Like a Pro This Holiday Season

Avoid financial stress by learning how to budget Christmas spending. Plan ahead and enjoy a debt-free and magical season.

Continúe LeyendoTambién te puede interesar

College Ave Loan: Learn More

Learn even more about College Ave and all you need to know on their loan, qualities, cons, and a lot more!

Continúe Leyendo

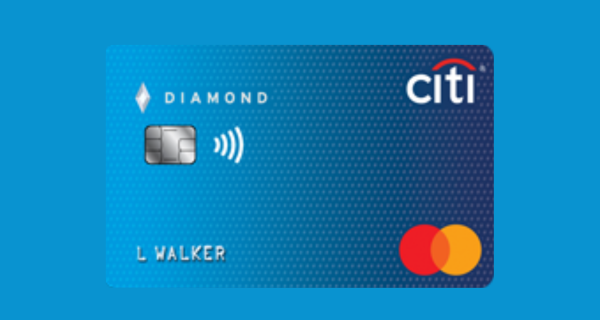

Review of the Citi Secured Mastercard® credit card

Find out all the advantages, disadvantages and requirements for applying for your Citi Secured Mastercard credit card!

Continúe Leyendo