Loans

College Ave Loan: Learn More

Do you want a good loan with many pros and few cons? Read on and we'll show you everything on this page. Also, learn to order at the end!

Advertisement

Get to know more qualities about College Ave loans!

How are you this beautiful day? I hope everything is amazing for you and everyone you know. But, if you are a student, then you must have this little voice inside your head asking how will you pay for college? College is expensive, that is a universal knowledge, and unfortunately, knowing it won’t change anything, so the last resort is to apply for a loan.

Yes, it may seem very annoying, you must think that you will be getting into dept and all that stuff, but believe me when I say, it will be worth it, and in the end, you will not be into debt. College Ave not only has the grace period program, but it can also be extended by 6 more months! That is enough to give you time to have a job and get stable. Now, let’s get started with?

What are the pros about College Ave loan?

The good side is always the best. I bet there isn’t anyone in the world that wishes to only see the bad side of things (at least I hope so). So now, even if you somehow wish to do that, maybe you should try looking for the good things, even small ones, like College Ave qualities! The first quality is probable one of the most useful ones, and it is the grace period extended period, but before that, we must know what grace period means.

Grace period is when, after you finish college, and you paid for it with loans, you will have a six month period to find a stable job and get financial stable, and only after that you can start paying (if you can pay before it’s okay too). But in College Ave, you can ask for an extensive six moth period, so you will have in total a whole year before you need to start paying your loans, which is more than enough to get into something!

The next quality is that you will have a bunch of different payment options, unlike other lenders. In College Ave you have different option for your student loan, some examples are: parent loans, undergraduates loan, etc. That will also mean you get to have different types of payment, and you can choose the one suits you the best!

600

3.24% to 12.99%

Loan terms range from five to 15 years

Late fee of $25 or 5% of the unpaid amount

0.25%

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

What are the cons of getting a loan with College Ave?

Well, this part was inevitable, and we have to go through it, but don’t you worry, we can do it. The cons of College Ave are not very bad, it could definitely be worse, but it isn’t, and actually, there is only one downside. The downside is that, if you wish to request a cosigner, you need to be at least halfway through the payment of your fee. If you are lower than that, you will not be able to get one.

What do I need to apply for the loan?

Altogether, there is one last thing you need to know about applying for a loan with College Ave, you need, obviously, to be at least 18 years old. Then, you also need to be a US citizen or an international student with a valid US social security number, you also need to be going to an US university or college, and borrow, at least $1.000.

Know how to apply for the loan with College Ave

You reached the end of our journey, but there is one more doorway that remains, well, not doorway, but it is just a metaphor, or a reference. Either way, if you enjoyed this company, then you probably want to know how you can apply for it and what do you need to do. This must be your lucky day, because now you will be able to see our step-by-step tutorial in how to apply for a loan with College Ave. Do not fear, it is a simple tutorial that anyone can understand, and if you wish to know more, or how to apply, click on the link below.

Trending Topics

See how to request the Credit One Bank Platinum Visa® Credit Card

Apply for your Credit One Bank Platinum Visa credit card. These are very good advantages to be offered! Keep reading to get it now.

Keep Reading

Apply for QuickLoanLink

It's finally here! The step-by-step tutorial on how to apply for loan with QuickLoanLink is here! Don't hesitate to learn and know more!

Keep Reading

See how to request the Wells Fargo Active Cash® Credit Card

Learn how to apply for the wells fargo active cash credit card and if it is really a good option for you! See now.

Keep ReadingYou may also like

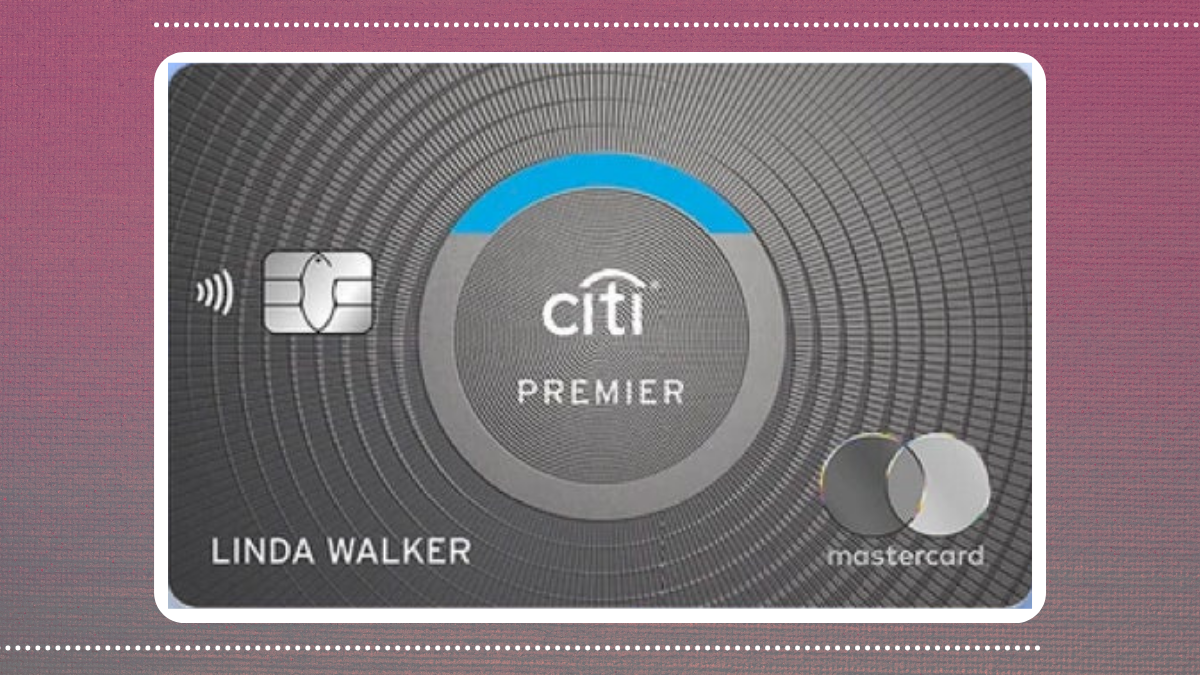

Citi Premier® review: is it worth it?

If you're looking for a travel credit card with excellent benefits, you should read this Citi Premier® review. This is the one, keep reading!

Keep Reading

5 essential tips on how to manage your mortgage and its payment

Do you know how to manage a mortgage? If you don't, this is your chance to learn! We've selected some tips to help you on this topic.

Keep Reading

10 tips on how to use credit cards to your advantage!

Learn how to use credit cards to your advantage, and enjoy the benefits they can provide you. Read these 10 tips and use your cards wisely.

Keep Reading