Credit Cards

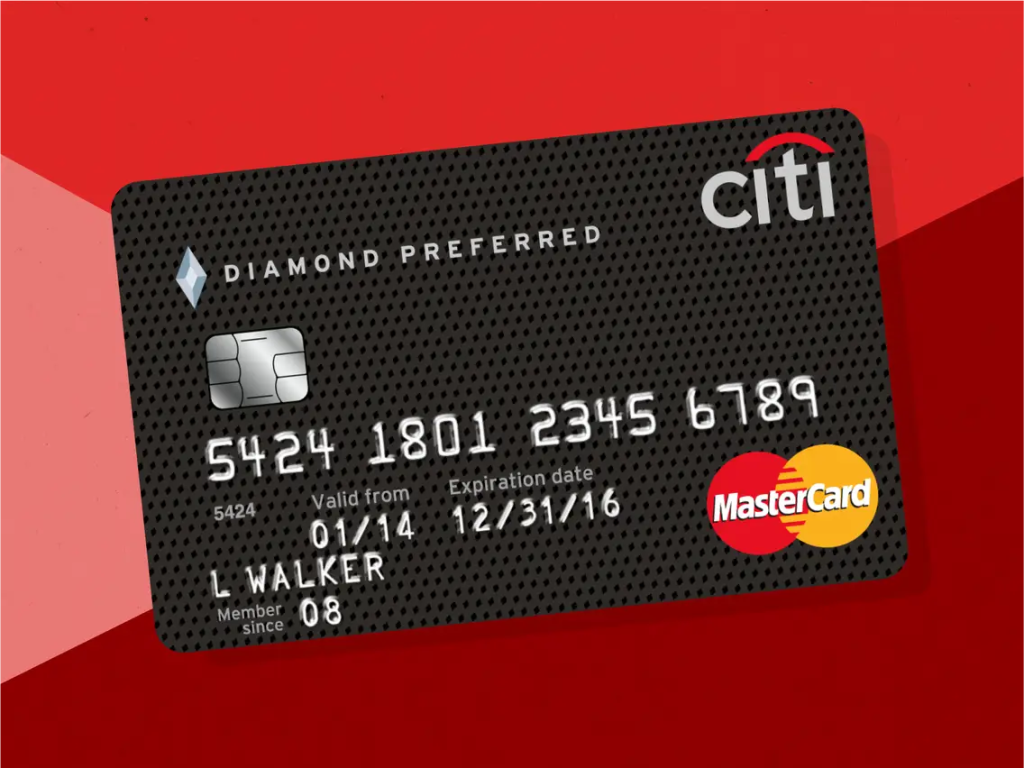

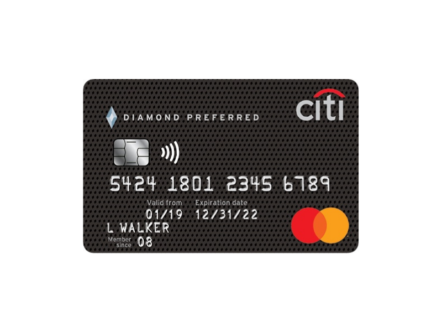

Review of the Citi Diamond Preferred® credit card

Advantageous credit cards are always welcome. If you want to know more, read on and find out more about the Citi Diamond Preferred review.

Anuncios

Read more about the Citi Diamond Preferred credit card, the card with no annual fee

In this article, our goal is to provide an honest and unbiased opinion about the Citi Diamond credit card. For this reason, by the end of reading, you will be able to understand how to apply for your card and you will also know more about the fees involved. Advantages, disadvantages and requirements for ordering yours.

In this way, it is worth remembering that we are not affiliated or contracted with this credit card. Therefore, the purpose is that it will help you understand a little more about this card and decide if it is a good long-term option.

We all know that credit card is one of the most used payment methods nowadays, and this is due to many factors. They are, firstly, that a credit card is able to offer many benefits to those who use it frequently. But as we know that the decision to choose an ideal credit card can be very difficult, we will help you with this and tell you a little more about this card. Without further ado, let’s find out right now, what are the advantages and benefits that you will have access to using this credit card option.

Credit card benefits

As we said earlier, we are here to tell you what the advantages of this card are. Starting with the fact that it doesn’t charge any annual fee, and that can be very attractive for some people. Because in case you didn’t know, the annual fee when charged must be paid, even if you don’t use the card. And that can be daunting, but in this case, you can breathe a sigh of relief as the annual fee is $0.

On the other hand, as soon as you start using your credit card you will have access to an introductory offer regarding the APR. In this case, the offer is considered too long due to its duration, and you will receive the benefit of paying nothing more for balance transfers performed.

And if you’re one of those people who always puts safety first, especially when it comes to financial services. Know that this card offers insurance and liability for unauthorized purchases. This is in cases of credit card fraud or theft.

Finally, with this card you will have access to the Citi Entertainment program which entitles you to discounts and rewards on purchases of tickets to concerts, movies and other entertainment Events.

Does not provide.

Not charged.

17.99% – 28.74%, variable rate

Excellent, good.

Serás redirigido a otro sitio

Credit card disadvantages

As stated above, our unbiased review will also consider what are the disadvantages and drawbacks of this credit card. Therefore, the first major disadvantage is if you are used to traveling a lot and carrying out foreign transactions. Because this card charges a fee of 3% on each foreign transaction carried out.

In addition, there are some cards that offer a rewards program where part of the amount you spend is converted into points that you can exchange for discounts and products later. However, this card does not offer any rewards program, and this can be a little detrimental for people looking for this program itself.

Finally, as we talk about the advantages you will have access to a long introductory offer on balance transfers, it is important to note that when you finish the introductory period, you will have access to an APR that is considered very high compared to other similar credit cards. So, after the sign-up bonus period, it might not pay off that much.

Requirements to apply for the card

Among the requirements to apply for this card, you must present proof of residence. In addition to proof of income, a personal document to prove that you are over 18 years of age and, finally, you will need to undergo an analysis that confirms that your credit score is excellent or good.

How do I apply for the Citi Diamond Preferred credit card?

As stated earlier, this is not a very good card for people who have a poor or average credit score. For one of the requirements is that you have a good Excellent credit score. This means that this card prefers customers who have good financial transactions and demonstrate responsible payment capacity.

With that in mind, the first step to applying for your card is to make sure that your credit score is currently at a good level to be approved. Later you can go directly to the website of the site and there you will have important information, such as a form to fill out. In this form, you need to be careful to fill in the information that will be requested, such as personal and financial information about your life.

In addition, it is important to have proof of income and residence at hand, as well as personal documents that must be requested to be attached in the analysis. After completing the form, you just need to wait until the bank analyzes your information and checks whether the card is eligible for you.

In general, this analysis is quick, but it may take a few days and you will receive a response to the email you registered. If approved, your card will be sent to the address you provided and you just need to unlock it to start using it immediately.

Our verdict on the card

Now the moment you’ve been waiting for has arrived. We’ll tell you if this credit card is really a good option and if it’s worth it. In general, our verdict on the Diamond preferred site is that it is a very interesting option for people who are looking to consolidate debt and pay for an excellent period of time. This is because this card can become a good ally, as it has a 0% introductory rate for the first 21 months.

That is, during this entire period of time, you can use the card without paying any APR fee. However, it is important to point out that, after that, the rate will be 17.99 to 28.99%, which may represent a slightly high rate. But if you use the card a lot in the first months when the rate is zero, it can be a considerable and compensating option.

Finally, it can also be considered a good option for people who do a lot of balance transfers, as they cost less than those offered by competing markets. In addition, of course, to the fact that the card does not charge any annual fee and you can use it without worrying about paying an annual fee.

Also check out the Mission Lane Visa

Now, if you want a recommendation of another option that may be very interesting for you, we can recommend you to click on the button below and learn more about the card and all that it offers.

Mission Lane Visa

Read a review of the advantages, disadvantages and requirements for applying for your Mission Lane Visa credit card.

Tendencias

Préstamo Personal Online Oney: hasta 45.000€ de forma 100% online

Oney ofrece préstamos rápidos, sin necesidad de cambiar de banco y con respuesta en 48 horas. Descúbrelo en nuestra reseña cómo solicitar.

Continúe LeyendoTambién te puede interesar

Financial Planning for beginners: 7 easy steps for getting started

If you're starting on your financial planning journey, we've got you covered! These 7 steps will help you get started on the right track.

Continúe Leyendo

TOP 10 real estate investing books for starters

To help you achieve your plans, we've made this list with the best real estate investing books for starters. Choose one and start learning!

Continúe Leyendo

Review of the BMO Cashback Business Mastercard® credit card

Your business deserves the best credit card. Discover everything the BMO Cashback Business Mastercard has to offer.

Continúe Leyendo