Credit Cards

Review of the Costco Anywhere Visa® credit card

See all about the Costco Anywhere Visa credit card. We'll walk you through the pros and cons of applying for this card, so you can make an informed decision whether you want it!

Anuncios

Find out why the Costco Anywhere Visa credit card might be a great choice for you.

If you want to discover a credit card option that can give you exclusive perks for shopping at specific stores, let us tell you an honest and candid opinion about the Costco Anywhere Visa credit card.

After all, you should know that a good credit card is one that offers you advantages just for doing what you are used to. Make purchases on a daily basis using this payment method, which is one of the most accepted worldwide.

At the end of this article, you will find out if the Costco Anywhere Visa credit card is a good option and will meet your needs. Because we will tell you all the advantages and disadvantages of acquiring this card. Here we will give you an honest opinion about this card!

Costco Anywhere Visa Credit Card Benefits

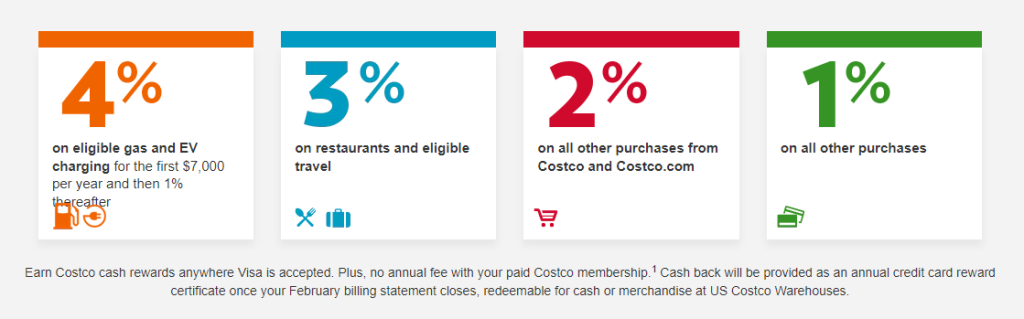

First of all, it is important to know that this card is an excellent choice, as it offers Cashback on regular purchases. This means that, when making purchases for your home, for your car or even having health expenses, you will have a part of the value back in your bank account as a balance.

And the advantages don’t stop there, as this card will help you save on your travel purchases and even day-to-day purchases. As well as expenses, gas taxes and meals. Another great advantage that we can highlight is that the card does not charge any annual fee. This means that you pay absolutely nothing to start earning the rewards, discounts and Cashback offered.

And finally, if you’re wondering if this card is only available for use at Costco stores, you’d be wrong. Because there is the possibility of using that credit card as a payment method anywhere else. That is, this is an open-use card and, in addition, you will also have advantages such as Cashback and other purchases in addition to the categories mentioned above.

720 – 850

N/A Earn Rate Up to 4% cashback on eligible purchases.

$0

Serás redirigido a otro sitio

What are the requirements?

This is a credit card that has some requirements to be provided to users. In this way, you should consider that the card is a good option for those who make recurring purchases at costco stores.

However, to do so, you need to pay for an in-store membership, which starts at 60 USD. So if you already have this active Membership, you won’t have to worry about anything else, as your card may already be available for you to save each year.

In addition, you must be 18 years of age or older. Finally, proof of income may be required. It is worth remembering that, as this card offers additional advantages over other competitors, proof of income must be slightly higher than normal.

And a credit check will also be done. That’s why you must have a positive credit score to get your application approved.

Costco Anywhere Visa Credit Card Disadvantages

As we say that we are here to provide a sincere and honest review of this credit card, it is important to know that there are some disadvantages to choosing this option. The first being the fact that the card does not offer any sign-up bonuses like some other financial institutions do. Also, one of the requirements is that you have an active membership with Costco, which comes at a considerable cost.

And finally, the disadvantage that may weigh more on the consumer’s decision is the fact that the rewards can only be redeemed once a year, which makes it a little more complicated to enjoy the benefits because you will need to wait for the 12-month period. To request redemption of your rewards during the credit card usage period.

How to get your Costco Anywhere Visa credit card?

Now we come to the part of the article you’ve been waiting for the most: the moment when we will teach you how to apply for your Costco Anywhere Visa credit card. If so, you’ve already looked at the requirements, haven’t you? You probably already know that the first one is to be a Costco member. If you have already completed this part, just access the website and check how to apply for your card. But we will tell you step by step.

First, you will need to fill out a form where you will provide your personal and financial information. In addition, you must be 18 years of age or older to apply for your card. Afterward, you must present personal documents, proof of residence, and proof of income. In this case, the proof of residence must be in your name and dated up to 3 months before.

As we said in the requirements section, this card may require you to have a higher monthly financial income. The bank needs to understand that you have the financial capacity to pay the installments. Therefore, one of the requirements may be that you present valid proof of income with consistent information.

Finally, you will fill out the form and wait until the financial institution responsible for administering the credit card has responded. In case of approval, you will receive your card at the registered address and simply unlock it to start using it immediately. Finally, you will be able to take advantage of the advantages that the card makes available to customers.

Is the Costco Anywhere Visa worth it?

As we said earlier, the purpose of this article is to offer you an honest opinion. It is worth noting that we are not affiliated with or associated with this credit card. Therefore, we want to ensure that you make an excellent financial choice. Therefore, it is important to know that this credit card can be worthwhile for people who frequently shop at Costco stores.

Also, if you drive a lot, you tend to frequent a lot of gas stations. Know that using this credit card will also give you additional advantages. However, it is worth remembering that the credit card has fees, and even if the annual fee is zero, you need to take into account the other fees involved in the process.

So, the answer to the question of whether it’s worth it depends on your current needs. If you are already used to using this credit card in partner or convenient stores, it can be an excellent alternative to gain additional benefits. However, if you do not use your credit card for these specific categories that we have mentioned here, this option may not be the most suitable, and it is important that you know other options before applying.

How about trying the GO2bank™ Secured Visa Card credit card

If you are looking for another credit card option that might be interesting, we recommend the GO2bank™ Secured Visa Card. Click below to learn more about it.

Tendencias

Citizens Bank: Learn More

Know more about Citizens Bank student loans! If you wish to continue your studies, check this company out and all their loans.

Continúe Leyendo

Discover it® Secured Credit Card: Build Your Credit While Earning Rewards

Boost your credit score the smart way! The Discover it® Secured Credit Card gives you cashback, no annual fee, and a shot at an upgrade.

Continúe Leyendo

Apply for LendKey Loan

Learn how to apply for a loan with Lendkey! Lendkey will help you with your doubts and hardships in the financial zone.

Continúe LeyendoTambién te puede interesar

785 credit score is an indicator of good or bad financial health?

If you have a 785 credit score you might be feeling very proud. But is it good or bad? This article will tell you more about this score.

Continúe Leyendo

Discover® Loan Review: Borrowe up to $40,000 to achieve your goals!

Learn more about Discover® Personal Loans and all you need to know to be able to qualify for a loan! Don't lose this chance.

Continúe Leyendo

American Express® Green Card Review: Your Daily Luxury Companion

The American Express® Green Card is designed to help you manage your everyday spending and enjoy various benefits. You'll want one; see why!

Continúe Leyendo