Credit Cards

Review of the Premier Bankcard® Credit Card

Would you like access to a good credit card review? Then check out the most famous credit card ever with exclusive benefits. We're talking Premier Bankcard! Read on.

Anuncios

Enjoy Premier Bankcard – One of the best credit cards with no credit history required

A good credit card is one that allows us several possibilities, without necessarily having to depend on a good credit history, right? That’s what Premier Bankcard is offering to all customers. You don’t need a security deposit, nor do you need to be the best customer in credit history.

We did a detailed analysis so that we can help you a little more on this credit card issue, so you can know the advantages and disadvantages to consider getting or not.

Advantages of the Credit Card Premier Bankcard

Let’s start with the benefits of this credit card so you know what it has to offer your customers.

The first big advantage is that card activity is reported to the credit bureaus. We don’t say it’s a good credit card to build your credit history for nothing. He really is one of the best as he always reports his activity to the agencies.

If you are a good credit card user, you can be sure that you will be able to take advantage of many credit bureaus. Pay on time and always use your credit card to make your purchases and you can be sure that soon you will be much better off at the credit agency.

Did you know that credit card payments account for 35% of your credit score? That’s why you should give so much importance to how this card can help you in this requirement.

You will have access to FICO scores. With this card, you can always be on top of that score. Some credit companies even offer the possibility of staying on top of this feature; however, it is a little rare and you should take advantage of this card being one of them.

Your account can be accessed 24/7 and even with customer support. That is, you will never run out of access, and you can always be on top of the changes and updates that the bank promises.

Another very interesting thing about this credit card is that all users will have access to security features. Mastercard’s identity theft protection is proprietary to the brand that backs the card and therefore is accessible to you and anyone who requests it.

Whenever they try to make a purchase on your credit card, you will not only receive a notification, but also protection in case a purchase is not made by you.

36% variable

$50-$125

This card has no rewards program

3%

Serás redirigido a otro sitio

Disadvantages of the Credit Card Premier Bankcard

Unfortunately, like all credit cards, this one is also going to have some downsides. We need to talk about them, so that you can make your decision with conscience and transparency.

The first downside is that, yes, the fees are sky-high, extremely high for credit card level. This has an explanation, it’s a card that doesn’t require a security deposit and on top of that it helps you improve your credit history.

Among the fees you will have to pay are the annual fee, monthly fee, penalty fee, additional user fee, express delivery fee and some others. No card withdrawals.

Another thing that also ends up making the card a little less attractive is the APR, which is extremely high. On average, for all cards, they offer this rate for 22.7%. We remind you that this value was updated in January 2023.

In addition, the fee for increasing the limit is also a bit expensive, after all, a fee is charged on top of how much your limit increases, which makes it a little impossible for you to grow within the company.

In addition to receiving your limit increased at this rate, you will be charged 25% of the limit increase amount, which can be quite a lot when you ask for a large increase. Many credit cards these days offer this for free, so it should be something to consider if you’re considering getting the card.

We can even come up with a practical example. Let’s imagine you want to increase your limit by 100 USD. A 25% fee will be required on top of that. That is, you need to pay 25 USD to the bank. Consider these and other disadvantages before applying for the card.

Premier Bankcard requirements

To apply for this credit card, you must be at least 18 years old, have a stable income, reasonable credit history and visa / nationality documents / other things that prove your legal stay.

Learn how to obtain the Premier Bankcard online

Applying for this credit card is quite simple. The first thing you will need to do will be to visit the official First Premier bank website itself. It is also possible that you received an invitation. To do this, simply accept the offer.

There, you must fill out the complete registration form, which will require all the documents mentioned above, in addition to your ssn date of birth, email address, income and other information.

Then it will be time for you to review your filled in information and check the box to consent to receive communications from the company. They regularly sent out disclosures. Then confirm that you have read the terms.

If you really want to complete the registration, just click the confirm button on the page and get your credit report. It will depend a lot on the bank and the people who are working now. There are people who receive a response in 60 seconds, while others need 10 business days to receive their long-awaited response.

I requested it, but how will you evaluate First Premiere my credit?

Once you have applied for this credit card, know that the bank will evaluate your application. In addition to checking your monthly and annual earnings, they will also take a look at your consumer profile.

Yes, this credit card offers opportunities for people who are starting their credit history or want to rebuild that history. However, because it is a card that makes all of this possible, people think that any type of credit history can be approved.

This is not true. The bank does not make it fully explicit what the required credit history range is. However, you need to at least have an acceptable credit history. This is very important so that you can, yes, be approved.

But is it really a good card?

It’s time for us to give our final verdict so you can know whether or not the credit card is worth trying out. In our opinion, this is a very good credit card for anyone who wants to start building a credit history or wants to recover a credit history that was previously spoiled.

For this, it serves very well because it does not need a security deposit and offers support to people who really need to improve their history. But if you are already a person with a good credit history and have the possibility of having another card, it is not worth it.

Its fees are absurdly high and that is why it is a very expensive credit card compared to others on the market that can give you a better experience. Unless you’ve exhausted all other credit options, don’t opt for this card.

Credit cards with a guarantee deposit can be much more economical in terms of fees. Of course, everything will depend on your needs at the time, your credit history and several other things that are not for us to decide.

Anyway, this was our verdict and our review about the credit card, and we hope it helped you a lot to decide more about your financial life.

How about trying the Credit One Bank Platinum Visa?

The Credit One Bank Platinum Visa is another way to get a good credit card without needing an excellent credit history. As the fees for this card are a bit high, perhaps opting for another credit card would be a good idea.

Just click on the button below, so you can understand a little more about this card and everything it has to offer. We want to help you understand that you don’t necessarily need to depend on a single financial product to be successful.

Credit One Bank Platinum Visa

See how you can apply for Credit One Bank Platinum Visa – A lot of new features for you!

Tendencias

5 essential tips on how to manage your mortgage and its payment

Do you know how to manage a mortgage? If you don't, this is your chance to learn! We've selected some tips to help you on this topic.

Continúe Leyendo

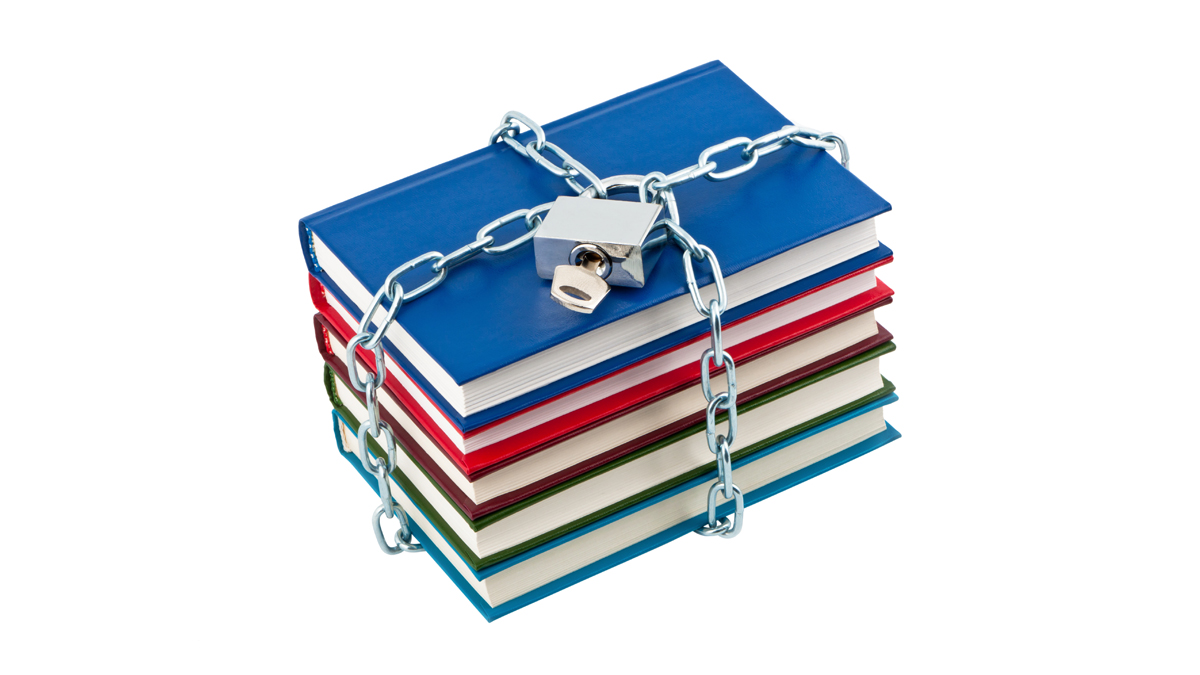

The number of banned books is on the rise again

What are the most commonly banned books and what are the reasons behind their censorship? Read on and find out why they've been targeted.

Continúe Leyendo

Maximize Your Costco Membership with the Costco Anywhere Visa® Card

Your Costco membership just got better! Learn how the Costco Anywhere Visa® Card turns everyday spending into big rewards.

Continúe LeyendoTambién te puede interesar

Home Trust Secured Visa Credit Card Review: The Category Champion

Meet the champion among secured cards. The Home Trust Secured Visa Credit Card is here to change the game!

Continúe Leyendo

Review of the Wells Fargo Active Cash® credit card

See a review with advantages and disadvantages of the Wells Fargo Active Cash credit card and if it is worth it!

Continúe Leyendo

Credit One Bank Platinum Visa: A Credit-Building Card with Perks

Cashback & Credit Growth? The Credit One Bank Platinum Visa offers both! But is it the right card for you? We break it down—pros and cons.

Continúe Leyendo