How about having a credit card without any credit score checks?

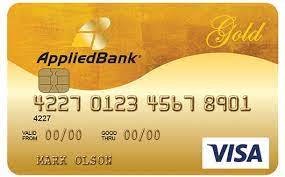

Preferred Visa Gold credit card: have your card approved without having to go through any previous verification.

Advertisement

Today we are going to tell you a little more about the Visa Gold Preferred credit card guaranteed by the applied bank. Therefore, you will understand why this card is a useful option for people who are starting their credit journey or even people who have experienced difficulties and currently do not have a very good credit score

Today we are going to tell you a little more about the Visa Gold Preferred credit card guaranteed by the applied bank. Therefore, you will understand why this card is a useful option for people who are starting their credit journey or even people who have experienced difficulties and currently do not have a very good credit score

You will remain in the same website

Find out what are the advantages of this credit card right now:

You will remain in the same website

Who is this card for

Before applying for any type of credit card, it is important to know which person it is best suited for, because cards have unique characteristics and advantages and it is important to know each one of them. Let’s tell you right now who this card’s target audience is:

Applied Bank Gold Preferred Secured Visa

See all about the Applied Bank Gold Preferred Secured Visa credit card and apply now!

People who are starting their financial life

Firstly, this card can be an excellent option for people who are starting their credit journey and that is, young people who have not yet made large financial transactions and may not have a very positive credit score in the market.

That is, as the card will not analyze past financial transactions, this can be a good option for people who have recently turned 18. They are starting to use credit cards now. Or even for people of legal age who have never been interested in using this payment method.

After all, it is very important for some institutions to have a very positive history of transactions in their name, but in the case of this specific card, you won’t have to worry about that.

People who are restoring their credit

Another target audience for this credit card is people who are currently restoring their credit. That’s because people often have debts that they couldn’t pay and after paying, they still continue with the famous dirty name in the market. Which can make it much more difficult to apply for a new credit card.

But in case of preferred credit card, Visa Gold, secured by applied bank, you don’t have to worry about it. Because the card is an ideal alternative for people who are currently restoring their credit.

Even so, it is worth remembering that we are not a partner or affiliate of any type of card, so we are here offering our sincere and honest opinion so that you can better understand which credit card is most suitable for your financial needs at the moment.

Discover the BMO Cashback Business Mastercard credit card

Now if you are looking for a card that meets your financial needs and can offer additional benefits. It may be worth your while to get to know the BMO Cashback Business Mastercard credit card. To do so, just click the button below and find out more.

BMO Cashback Business Mastercard

See all about the BMO Cashback Business Mastercard credit card and apply now!

Trending Topics

Review of the Wells Fargo Active Cash® credit card

See a review with advantages and disadvantages of the wells fargo active cash credit card and if it is worth it!

Keep Reading

Review of the Fortiva Mastercard® credit card

Find out in this article what are the requirements, advantages and disadvantages of the Fortiva Mastercard credit card!

Keep Reading

Review of the Discover It Secured® credit card

Find out if the Discover It Secured Credit Card is worth it, what advantages and disadvantages and requirements!

Keep ReadingYou may also like

Review of the Premier Bankcard® Credit Card

A good credit card offers a good service to every client. See how to apply for Premier Bankcard, an incredible card in EUA!

Keep Reading

Review of the Wells Fargo Reflect® credit card

Read our full review of the Wells Fargo Reflect Card now. Perfect for people who want easy perks. See all about it!

Keep Reading