Capital One Platinum Card: Find out why this can be a good credit card option that does not charge annual fee.

Learn why capital One Platinum can be an excellent credit card option for anyone looking to increase their limit considerably.

Advertisement

Have you ever stopped to think that when using a credit card many times your limit is stagnant for many years? With that in mind, we are going to tell you a possibility of a credit card that increases your limit as you use it responsibly. In addition, this card does not charge any annual fee and can be a very advantageous option. Shall we find out a little more about it?

Have you ever stopped to think that when using a credit card many times your limit is stagnant for many years? With that in mind, we are going to tell you a possibility of a credit card that increases your limit as you use it responsibly. In addition, this card does not charge any annual fee and can be a very advantageous option. Shall we find out a little more about it?

You will remain in the same website

Check below what are the benefits and advantages offered by this credit card.

You will remain in the same website

Is it a good option for people with bad credit?

The answer to that question is: yes. Overall, this can be an excellent credit-building opportunity. This means that this card can be indicated for people who are starting their financial life or are restoring their credit score.

And if you don’t know, building credit means that you will be able to improve your credit score and improve it so that you can upgrade to other types of credit cards in the future. Because many institutions only provide the card to people who have proven in recent months that they can handle a credit card and have the financial capacity to pay on time.

Capital One Platinum

Find out all the advantages, disadvantages and requirements for applying for your Capital One Platinum credit card!

So if you are looking to increase your credit score, this card can be an excellent alternative for you, as it will help you a lot in this regard. After all, there are many financial institutions providing credit cards that do a very detailed analysis to provide the card. And that may not be very positive for people who haven’t had much financial movement recently.

What do people say about this card?

To analyze whether the card is a good option, it is important to analyze what people say about it out there. Therefore, based on the reports we had access to, many people like this card precisely because it is a good opportunity for people with bad credit, that is, it represents a good opportunity for those who are starting out and can be a great starting card.

In addition, people who travel a lot of report that they use this card on their trips and do not face any type of unforeseen or inconvenience with it. But it must be taken into account that the card does not offer rewards, such as Cashback or points programs. That is, if this is one of your goals with the card, you better reconsider. But taking into account that it does not have many requirements and still does not charge an annuity fee, it may be a good choice in the end.

How about getting to know Wells Fargo Active Cash?

If you want to know another credit card alternative, we can recommend one for you. Just click the button below and you will have access to all the information about the Wells Fargo Active Cash Card.

Trending Topics

Review of the Upgrade Triple Cash Rewards® credit card

Find out in this article what are the advantages and disadvantages of the Upgrade Triple Cash Rewards credit card.

Keep Reading

Apply for College Ave Loan

Get to know more about College Ave and hot to apply for their loans with this amazing tutorial and a very simple step by step!

Keep Reading

What HCOL area means: it affects your life?

Learn the meaning of HCOL, so you can make better choices at life. This impacts every aspect of your life, so keep reading to learn about it.

Keep ReadingYou may also like

Why budgeting is important? 9 simple tips to improve your financial life

Do you know why budgeting is important? You need a budget if you want to accomplish your dreams. Check these tips to start your own.

Keep Reading

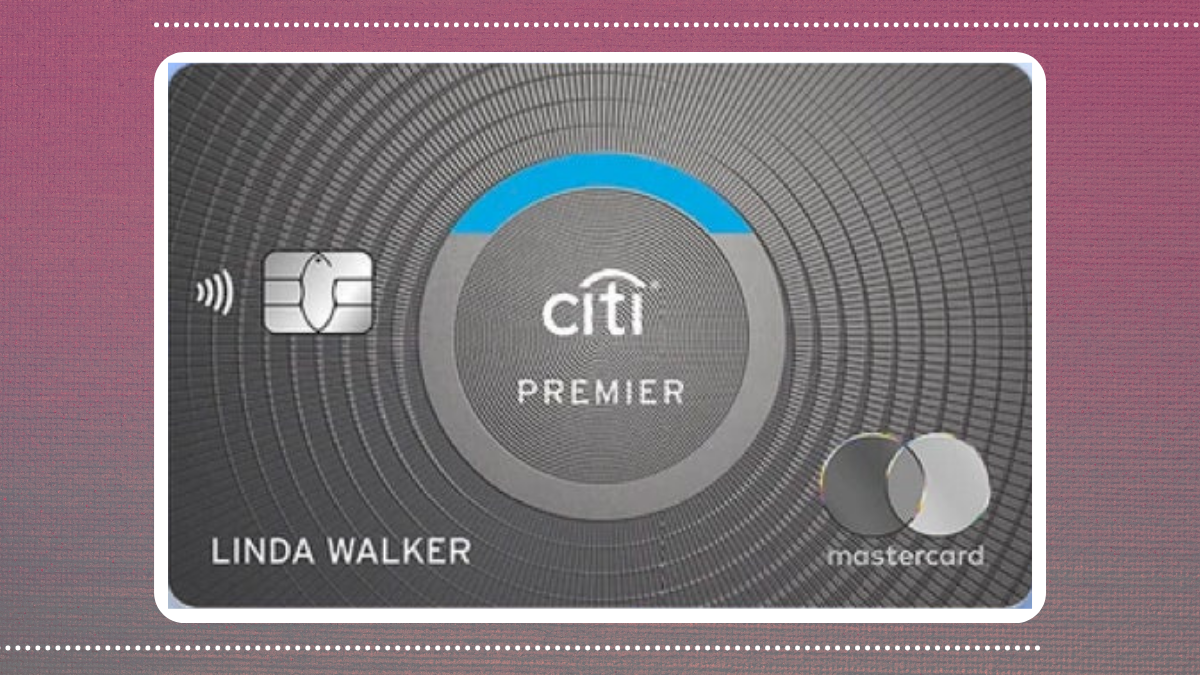

Citi Premier® review: is it worth it?

If you're looking for a travel credit card with excellent benefits, you should read this Citi Premier® review. This is the one, keep reading!

Keep Reading