Credit Cards

See how to request the FIT Credit Card Mastercard® Credit Card

We have here a step-by-step guide so that you can easily apply for the FIT Credit Card Mastercard credit card. Keep reading and enjoy every benefit, see everything we must show you!

Advertisement

Apply for your FIT Credit Card Mastercard and increase your limit quickly

Enough of depending on credit cards that, in addition to not offering a good limit increase, don’t offer anything much for you. The Fit Credit Card Mastercard is here to change the reality of all Americans who are tired of not being able to start a good credit score.

We are talking about a credit card that is easy to apply, accepts people with a not so high credit score and is very simple to use. Today we will teach you how to finally apply for that credit card simply and easily online, without having to go to a branch.

In addition, we’ll talk about some requirements you need to meet to apply for the card, and we’ll give you a final verdict saying whether it’s worth having this card within your line of credit cards. We can tell you that it’s worth it most of the time!

Then continue reading to find out everything about the subject and take advantage of all the knowledge we must pass on to you here at The Money Best!

FIT Credit Card Mastercard requirements

To apply for this credit card, in addition to being a US citizen, having an identification document and being 18 years old, you must prove your credit score.

Any other additional documents can be consulted with the bank when applying for the card.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive marketing messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Learn how to obtain the FIT Credit Card Mastercard online

It’s time you most should be dying to know. Time to apply for the credit card so you can add it to your favorites list. To get started, you will need to go directly to the official website of the FIT Mastercard credit card.

Entering the site, you will be able to see all the information about the credit card, in addition to knowing a lot of things, whether or not it is worth requesting. Of course, you’ve already been able to check all the benefits and harms of the card, so it’s time to just apply.

To do this, just click on the button and fill out the entire questionnaire that will appear online. With this questionnaire, you will be able to start applying for your credit card and guarantee the best limit.

The answer should come quickly, but if it doesn’t, don’t worry. Usually banks can take a few days, especially if you are not on 1 business day.

If you have any doubts about applying for your FIT credit card, you can speak directly with Mastercard customer service support or even ask your questions. If we know the answer, we can help you.

But, is it really a good card?

Another concern of customers is whether this card is worth it. After all. We are going to be very honest here, we are not affiliated with the credit card and so we just want you to make your best choice.

If you don’t have good credit and have a low score, it’s worth it, after all, it’s easier to access and it’s a card that often doesn’t need a security deposit. You will have an opportunity to restore and rebuild your credit that many credit card companies do not offer.

However, we need to remind you that credit cards have fees. The rates are not at all low, as we always say around here, when you opt for a credit card that doesn’t have a mandatory deposit, the rates start to be higher, because you don’t necessarily guarantee that you will pay that card.

If you give a mandatory deposit, this is not a good card for you, as there are other credit cards that do not allow you to not give a mandatory deposit and therefore have better rates.

This card is really for those people who need to improve their credit history and it is meant to be one of the last options in that case. If no other credit card approves you, that has lower rates than this one, yes, it is very worthwhile.

We must remember that there are fees for any type of purchase you make International, annuity fees and several others that are often not smart for some consumers. You must also have a smart spending habit to avoid expenses.

This is our opinion, but if you want to see another credit card, be sure to see our other recommendation below.

How about trying the Chase Sapphire Preferred credit card?

There are other very interesting credit card options, and today we are going to recommend Chase to you. Just click the button below to learn more about it!

Chase Sapphire Preferred

Apply now for Chase Sapphire Preferred with several advantages and low fees!

Trending Topics

SoFi Personal Loan: Learn More

If you wish to know all the good qualities SoFi Personal Loan has, then this is the article you've been looking for!

Keep Reading

People are prioritizing student loan debt payment over savings

Many student loan borrowers have put their savings plans on the backburner while they focus on paying down their debt. Learn more here.

Keep Reading

Review of the Chase Sapphire Preferred® Credit Card

We have for you one of the best credit cards that exist. Check out now everything you need to know about the Chase Sapphire Preferred.

Keep ReadingYou may also like

See how to request the Fortiva Mastercard® Credit Card

Read this article and quickly learn how to apply for your Fortiva Mastercard credit card right now! See all about this.

Keep Reading

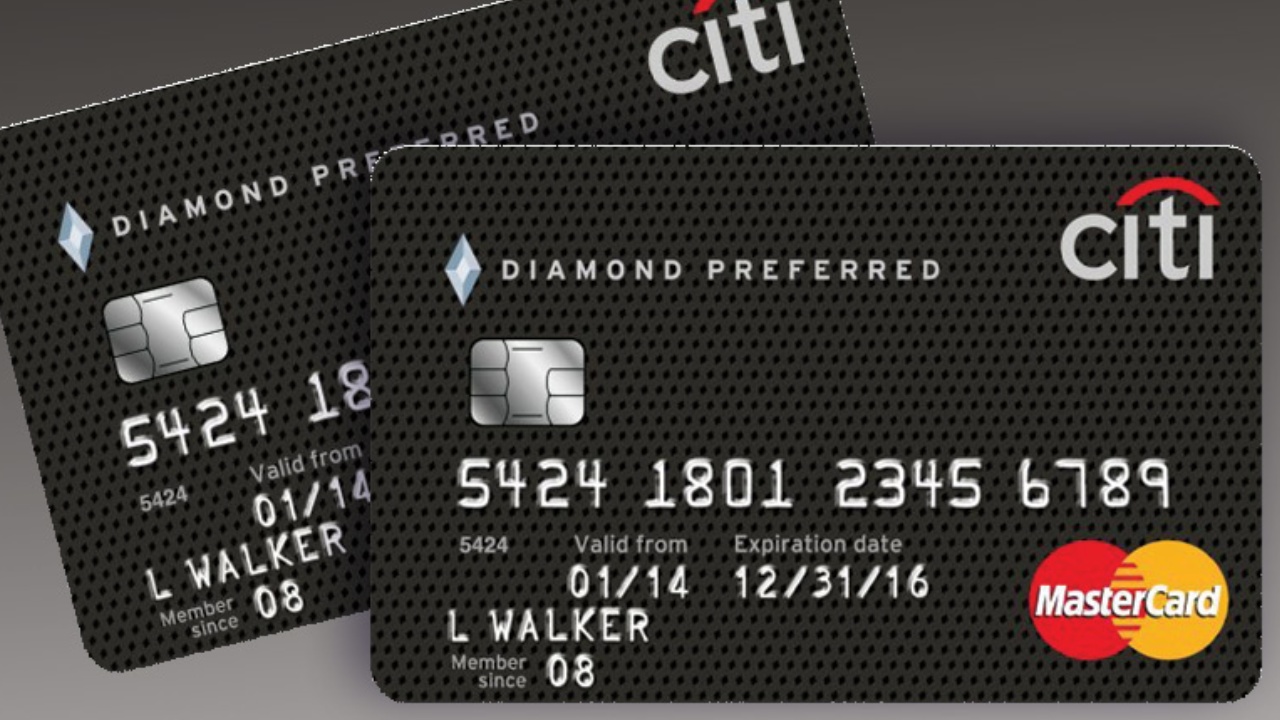

Review of the Citi Diamond Preferred® credit card

Read a review of the advantages, disadvantages and requirements for applying for your Citi Diamond credit card.

Keep Reading

Review of the BMO Cashback Business Mastercard® credit card

Get to know the Amazon Prime Rewards credit card, what advantages it offers and which people it is suitable for!

Keep Reading