Credit Cards

Review of the Capital One Platinum® credit card

See an important summary about the Capital One Platinum credit card and everything it can offer its users.

Anuncios

Discover the Capital One Platinum card and find out how to increase your credit limit with this card

In this article, we are going to tell you a little more about the One Platinum credit and capital card and everything it offers to its users. In this way, at the end of reading this article you will be able to understand what are the advantages, disadvantages, requirements and if it really is a worthwhile card. Because in general, this is a card that is highly requested by people looking for safe and advantageous options.

However, it is worth mentioning that here we are doing an impartial analysis of the credit card, which means that we are not affiliated with or associated with this card. Therefore, we are going to give you an honest opinion about it, so that you can understand if it really is an option that suits your needs and meets everything you expect. Let’s find out right now, what are the advantages of this credit card.

Capital One Platinum benefits

First, it is worth mentioning that this is a simple credit card and represents a good opportunity for people who are on the rise in credit. That is, people who do not have a very high credit score and may have difficulty obtaining other types of cards.

Therefore, one of its advantages that draws the most attention is the fact that it does not charge an annuity, that is, you can use the card for a period of time without having to pay anything extra for it. And if we compare it with other cards that charge annual fees that are often high, this can be a benefit that draws a lot of attention.

On the other hand, users also report that this card is a very attractive option for people who want to increase their credit limit in a short period of time. This is because, periodically, the bank will analyze your financial behavior and, if you represent the payment of installments and invoices responsibly, your limit will be frequently readjusted. Which can result in an attractive long-term credit limit.

Zero.

29.99%. Variable rate.

Zero.

Average.

Serás redirigido a otro sitio

Credit card disadvantages

As we mentioned earlier, we are here to give you an impartial review of this credit card and therefore we will also let you know what are the disadvantages of getting this product. Therefore, it is important to know that the first major disadvantage noticed by users is the fact that it has a very high fee for use.

This means that although it does not charge an annual fee, the APR is very high, especially when compared to other similar credit cards. Also, another factor that unfortunately can be a negative is the fact that the card does not offer rewards.

This means that you will not be able to count on the points program, Cashback programs and any other expected rewards, usually on credit cards.

From this we can conclude that this credit card can be easily compared with others and the benefits are not as attractive as the disadvantages, as in the case of presenting a rate considered too high. In addition to not offering any additional rewards.

Requirements to apply for the card

As you probably already know, credit cards require some minimum requirements in order to get approved, and the Capital One platinum card is no different. However, in this case, as it is a card intended for people who have a relatively low credit score, it does not have many requirements.

However, it is important that you are over 18 years old to be able to apply for the card and also present some important documents. Such as proof of residence, as well as proof of income and personal documents.

Learn how to apply for your Capital One Platinum card

One of the reasons this card stands out is the fact that you can have your approval cleared in seconds. And that’s exactly what you just read! Know that when you access the website and apply for the card, your order can be approved in less than a minute, and you will later receive the product at your home to unlock and start using it.

However, it’s important to keep in mind that there are some requirements that we talked about earlier. Therefore, know that you need to comply with them in order to succeed in your request. So, after making sure that you meet all the requirements, just access the website, fill out the form.

In this form you will provide important information regarding your personal and financial data and you will also need to attach some documents. For example, proof of income, proof of residence and personal documents.

Finally, your request will be analyzed, which may take a few seconds, as we mentioned earlier. And in case of approval, you will have a positive answer and you will receive your credit card at the address you provided.

Is the Capital One Platinum credit card really worth it?

As promised, now we are going to give you a final verdict, so you can understand if this card is really worth it and fulfills what it promises. Therefore, it is important to emphasize again that as much as you do not earn, no rewards with this card, it is possible to save a good amount of money in fees.

That’s because it has zero annual fee, and you also won’t pay anything extra for foreign transaction fees if you shop abroad. In addition, the chances of increasing your credit limit periodically is a factor that draws a lot of attention from people who want a higher limit and use the card very often.

Because of using your card responsibly, it will be carried out on a recurring basis and you can have your limit. It is increased in just 6 months after starting to use it.

Also check out Wells Fargo Active Cash

In case you weren’t very interested in that credit card we just described and want a second opinion. We can recommend Wells Fargo Active Cash to you.

That way, you just need to click the button below, and you will be redirected to a page. In which you will have access to all the important information relating to that credit card. As well as the way to order the requirements, advantages and disadvantages.

Tendencias

Consigue préstamos personales de hasta 30.000€ con PréstamoPro

Encuentra el préstamo perfecto para ti en PréstamoPro. Proceso 100% online, respuesta inmediata y sin papeleo complicado. ¡Infórmate ya!

Continúe Leyendo

Total Visa® Card review: 1% cashback on every purchase

Rebuild credit and earn 1% cashback on all your purchases? Discover the Total Visa credit card and change the course of your credit profile.

Continúe LeyendoTambién te puede interesar

Apply for College Ave Loan

Get to know more about College Ave and hot to apply for their loans with this amazing tutorial and a very simple step by step!

Continúe Leyendo

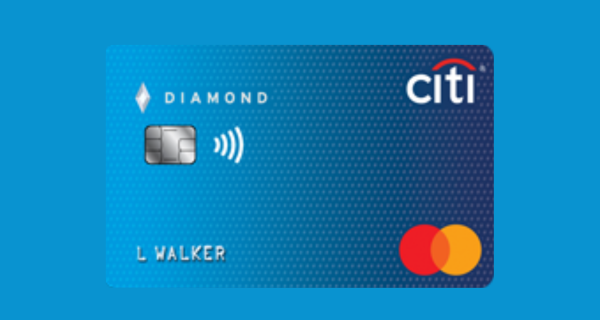

Review of the Citi Secured Mastercard® credit card

Find out all the advantages, disadvantages and requirements for applying for your Citi Secured Mastercard credit card!

Continúe Leyendo

Financial Planning for beginners: 7 easy steps for getting started

If you're starting on your financial planning journey, we've got you covered! These 7 steps will help you get started on the right track.

Continúe Leyendo