Credit Cards

Review of the FIT Credit Card Mastercard® credit card

Ever heard of the FIT Credit Card Mastercard? It's a credit card with a good limit and incredible benefits. Keep reading to understand more about this credit card. See our entire review.

Anuncios

Get to know FIT Credit Card Mastercard better and understand how you can increase your credit limit in 6 months

A good credit card can provide you with incredible experiences and that’s what the Mastercard brand has done with all the cards it co-signs with. The credit card we are going to talk about today is the FIT Credit Card Mastercard. Currently, it is one of the best credit cards that offer fast limit increase.

Have you ever faced that difficulty in finalizing a purchase, but couldn’t because of the low limit? Also, have you ever had trouble getting a card that doesn’t require a security deposit in advance? All solutions to your problems are here.

Keep reading to find out a little more about a brief review of the FIT credit card and how it can fit into your financial routine.

Advantages of the Credit Card FIT Credit Card Mastercard

To start our Fit Mastercard credit card review, we need to start by talking about the benefits so that you can compare them with the harm. See what’s good about the card!

Initially, you may have already realized that the biggest benefit that this credit card offers and publicizes to everyone is the fact that you can increase your credit limit after the first 6 months of using the card. Normally, people are approved to use the credit card with a line of 400 USD.

However, by making correct payments and using the card responsibly, we can ensure that the bank can even double your credit line. Every 6 months, you can consecutively request higher limits and increase your purchasing power in the financial market.

Accepts applicants with poor or no credit The barrier to entry for the Fit Mastercard® credit card application is very low, and those with poor or no credit are welcome to apply. Repairing or boosting your credit is one of the main uses of this card. It reports to all major credit bureaus and provides a free monthly credit score check.

Another great benefit is that this is a credit card that does not require a guaranteed deposit, which already broadens the horizons for people who cannot afford to spend that money. That way, you can open an account more easily without that deposit, and you can have a credit card without high initial payments.

If you are mindful of your monthly credit score, you can have a great benefit here, as the Fit Mastercard card also offers this free score. You just need to sign up for electronic statements and you will have access to this feature easily.

The score can be checked every month. Whenever and wherever you want, you can always be aware of how your financial resourcefulness is doing. That is, you will much more easily get results on your score, building a better credit score.

Have you ever faced the difficulty of having to lend your credit card to someone or someone in your family? Well, with this card you get additional authorized users. You only need to pay USD 30 for each additional user to use your card.

Finally, one of the biggest advantages of this credit card is the fact that the fraud protection is quite powerful. If there is any kind of illegal charge on your credit card, you can rest assured that you will not be charged for it.

29.99%

$99

Unspecified

Unspecified

Serás redirigido a otro sitio

Disadvantages of the Credit Card Fit Credit Card Mastercard

Among the disadvantages, we need to mention how the fees for this card are usually a little high. Well, we can’t say they are as high as some of the other cards we’ve already featured here. However, 29.09% APR is a bit high.

Other charges can be part of this as well, for example the $89 processing charge and late or bounced payment charges which can be up to $40. Other than that, you also incur foreign transaction fees of 3% and 5% percent if you need to advance money.

The annual fee charge is 99 USD and the monthly maintenance fee is 6.25 USD.

FIT Credit Card Mastercard requirements

To apply for this credit card, in addition to being a US citizen, having an identification document and being 18 years old, you must prove your credit score.

Any other additional documents can be consulted with the bank when applying for the card.

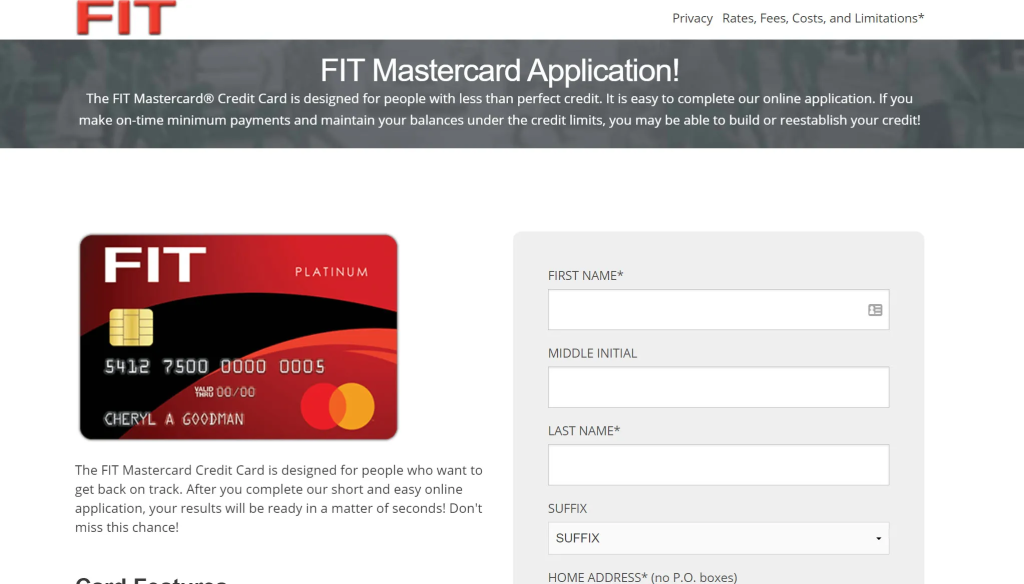

Learn how to obtain the FIT Credit Card Mastercard online

It’s time you most should be dying to know. Time to apply for the credit card so you can add it to your favorites list. To get started, you will need to go directly to the official website of the FIT Mastercard credit card.

Entering the site, you will be able to see all the information about the credit card, in addition to knowing a lot of things, whether or not it is worth requesting. Of course, you’ve already been able to check all the benefits and harms of the card, so it’s time to just apply.

To do this, just click on the button and fill out the entire questionnaire that will appear online. With this questionnaire, you will be able to start applying for your credit card and guarantee the best limit.

The answer should come quickly, but if it doesn’t, don’t worry. Usually banks can take a few days, especially if you are not on 1 business day.

If you have any doubts about applying for your FIT credit card, you can speak directly with Mastercard customer service support or even ask your questions. If we know the answer, we can help you.

But, is it really a good card?

Another concern of customers is whether this card is worth it. After all. We are going to be very honest here, we are not affiliated with the credit card and so we just want you to make your best choice.

If you don’t have good credit and have a low score, it’s worth it, after all, it’s easier to access and it’s a card that often doesn’t need a security deposit. You will have an opportunity to restore and rebuild your credit that many credit card companies do not offer.

However, we need to remind you that credit cards have fees. The rates are not at all low, as we always say around here, when you opt for a credit card that doesn’t have a mandatory deposit, the rates start to be higher, because you don’t necessarily guarantee that you will pay that card.

If you give a mandatory deposit, this is not a good card for you, as there are other credit cards that do not allow you to not give a mandatory deposit and therefore have better rates.

This card is really for those people who need to improve their credit history and it is meant to be one of the last options in that case. If no other credit card approves you, that has lower rates than this one, yes, it is very worthwhile.

We must remember that there are fees for any type of purchase you make International, annuity fees and several others that are often not smart for some consumers. You must also have a smart spending habit to avoid expenses.

This is our opinion, but if you want to see another credit card, be sure to see our other recommendation below.

Not sure about this card? Here’s another great option!

If you’re hesitating about applying for the First Digital NextGen credit card, that’s totally understandable! Choosing a financial product is an important decision, and it’s always best to pick one that truly fits your needs.

That’s where we come in! Our site is packed with reviews and insights on different credit cards, helping you compare options and make the right choice.

How about considering a credit card that offers cashback? Even if your credit score isn’t perfect, you can work on improving it while earning rewards for your everyday purchases.

Want to learn more? Click the link below and check out the Total Visa credit card!

Tendencias

Wells Fargo Active Cash® Card: Your Simple, Unlimited Cash Back Solution

Earn unlimited 2% cash back on every purchase with the Wells Fargo Active Cash® Card. No fees, no categories—just rewards.

Continúe Leyendo

Why budgeting is important? 9 simple tips to improve your financial life

Do you know why budgeting is important? You need a budget if you want to accomplish your dreams. Check these tips to start your own.

Continúe LeyendoTambién te puede interesar

Review Reflex® Platinum Mastercard®

No more being declined by credit card issuers. The Reflex Platinum Mastercard is your partner on your credit rebuilding journey.

Continúe Leyendo

LendingPoint Personal Loan: Learn More

Get to know more about LendingPoint Personal Loans with us! This company will give you the best deals, and make the process easy.

Continúe Leyendo

Earnest Student Loans: Learn more

Get to know more about the amazing student loans company Earnest Student Loans! Click on this article to learn more.

Continúe Leyendo