Discover Credit One Bank Platinum Visa and apply without deposit of guarantee

Credit One Bank Platinum Visa: No escrow and full of possibilities

Advertisement

For people just starting to build their credit history, surely a security deposit may not be very attractive. Thousands of Americans need good credit every day and Credit One Bank Platinum Visa can be a great ally! Today we are going to show you the pros and cons of this credit card so that you know if it is worth applying for. To do so, click the button below and enjoy the information!

For people just starting to build their credit history, surely a security deposit may not be very attractive. Thousands of Americans need good credit every day and Credit One Bank Platinum Visa can be a great ally! Today we are going to show you the pros and cons of this credit card so that you know if it is worth applying for. To do so, click the button below and enjoy the information!

You will remain in the same website

Want to know the biggest benefits of Credit One Bank Platinum Visa? Keep reading and see everything we have to say about him!

You will remain in the same website

How does Credit One Bank Platinum Visa compare to other cards for fair credit?

When we compare this credit card to several other credit cards that are ready to enter your financial life, we can see that the others tend to be even more confusing. Rewards are somewhat limited.

Whether that credit card will be worth it for you will depend on several things beyond that. There are several other cards that are specific to people who have goals in them. As an example, there are other cards that are better for students.

Credit One Bank Platinum Visa

See how you can apply for Credit One Bank Platinum Visa – A lot of new features for you!

We can mention, for example, the Cromo Discover it student, which offers an incredible 2% reimbursement rate, in addition to other advantages such as discounts at gas stations. Plus, you’ll also get a restaurant discount every quarter and 1% back on all other purchases you make.

Compared to this credit card that we are introducing you to, Discover also has some other advantages that may be interesting. In the long term, it tends to be less expensive for those who study, after all, it is possible to save with the Cashback rate.

However, the card we are presenting here does not need security deposit. Discover requires you to make a deposit. We know that cards that don’t have a security deposit tend to have higher fees to compensate for this. So everything will be a matter of priority.

If you need a credit card that doesn’t require a security deposit, we can tell you that this one is amazing. If you prefer a more student-oriented credit card, maybe you should try Discover.

Credit Protection Program

We couldn’t talk about a credit card without mentioning that there is a credit protection program. We’re talking about Credit One offering an amazing program that will protect you and waive your minimum payment for 6 months if you become unemployed.

Such a credit protection program is paid, but the amount is quite insignificant. You will need to pay 96 cents for every 100 USD of your balance per month. It’s a low price to pay when you get incredible protection.

If anything happens, don’t worry, you’re covered by this program as long as you pay that small fee of 98 cents. Well, we think it’s really worth it and can keep you safe all the time.

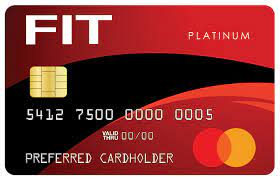

Also try the FIT Mastercard credit card

For those who want a credit product with a completely different proposal, we recommend the FIT Mastercard. It can be a great way for you to start in the world of credit without necessarily opting for a card with such high fees.

If you’re curious, just continue reading by clicking the button below and taking advantage of the information we’ve separated for you.

Trending Topics

Earnest Student Loans: Learn more

Get to know more about the amazing student loans company Earnest Student Loans! Click on this article to learn more.

Keep Reading

Discover®: Learn More

Learn more about Discover® Personal Loans and all you need to know to be able to qualify for a loan! Don't lose this chance.

Keep ReadingYou may also like

Apply for LendingPoint Personal Loan

Learn now the step by step on how to apply for a loan with LendingPoint Personal Loan! One of the best companies for personal loans.

Keep Reading

Neo Secured Credit Card Review: For anyone? No, for you!

The Neo Secured Credit Card accepts everyone - including you. With this credit-building tool, anything goes! Check the full review.

Keep Reading

SoFi Personal Loan: Learn More

If you wish to know all the good qualities SoFi Personal Loan has, then this is the article you've been looking for!

Keep Reading