Introducing Total Visa® Card – Get 1% cash back on payments!

Experience credit even with a low or unfavorable credit score!

Advertisement

Take a stride toward building credit swiftly with the Total Visa® Credit Card! Offering 1% cash back on your payments and reporting your financial activities to major credit bureaus! If you are searching for a credit card that could assist in constructing or mending your credit, Total Visa® Credit Card is a reliable choice to contemplate. If this card caught your attention, read the full review and learn how to apply for it!

Take a stride toward building credit swiftly with the Total Visa® Credit Card! Offering 1% cash back on your payments and reporting your financial activities to major credit bureaus! If you are searching for a credit card that could assist in constructing or mending your credit, Total Visa® Credit Card is a reliable choice to contemplate. If this card caught your attention, read the full review and learn how to apply for it!

You will remain in the same website

Take a look at the advantages that come with applying for a Total Visa® Credit Card and get started today!

You will remain in the same website

After a six-month period of using your Total Visa® Card, you’re eligible to call customer service at (877) 480-6988 to request a higher credit limit. Ensuring timely payments for a consecutive six-month period, reducing your outstanding debt, and updating your income details with the Bank of Missouri can improve your chances of approval for a raised credit limit. If your revised income details suggest that you’re well-equipped to handle a larger credit limit, they’re more likely to approve your request.

The Total Visa® Credit Card serves as an excellent tool for quick credit building or rebuilding. This card welcomes applicants irrespective of their credit status. To rejuvenate your credit, ensure to pay your bills punctually and use your card responsibly. The Bank of Missouri will consistently report your payment history to the key credit bureaus – Equifax, TransUnion, and Experian.

To seek assistance related to your Total Visa Card, feel free to call at (844) 548-9721. For inquiries about applying for a Total Visa Card or for addressing issues related to the Total Visa program fee, dial (844) 206-4371. Additionally, you can leverage their user-friendly mobile app or navigate their website for further support!

Credit cards like the Total Visa can be powerful tools for building credit.

By using the card for everyday purchases and consistently paying your balance in full each month, you demonstrate responsible credit usage to credit bureaus.

This can significantly improve your credit score over time, which unlocks a world of financial benefits.

A good credit score can lead to easier loan approvals, lower interest rates on mortgages and car loans, and even better insurance rates.

So, using a credit card responsibly can not only establish your credit history but also save you money in the long run.

If you’re ready to step into a new era on your credit score journey, check the following link for our full review and learn how to apply for your Total Visa credit card.

Total Visa Card

Struggling with poor credit? Discover how you can apply for the Total Visa® Card in this guide, and start enjoying a 1% cashback on your purchases!

If you’re still on the hunt for a financial solution that aligns with your needs, don’t forget to check out the content on OK Save Money!

Our review of the Opensky Visa® Card might catch your interest – it’s known to be one of the top choices for those dealing with poor credit!

Trending Topics

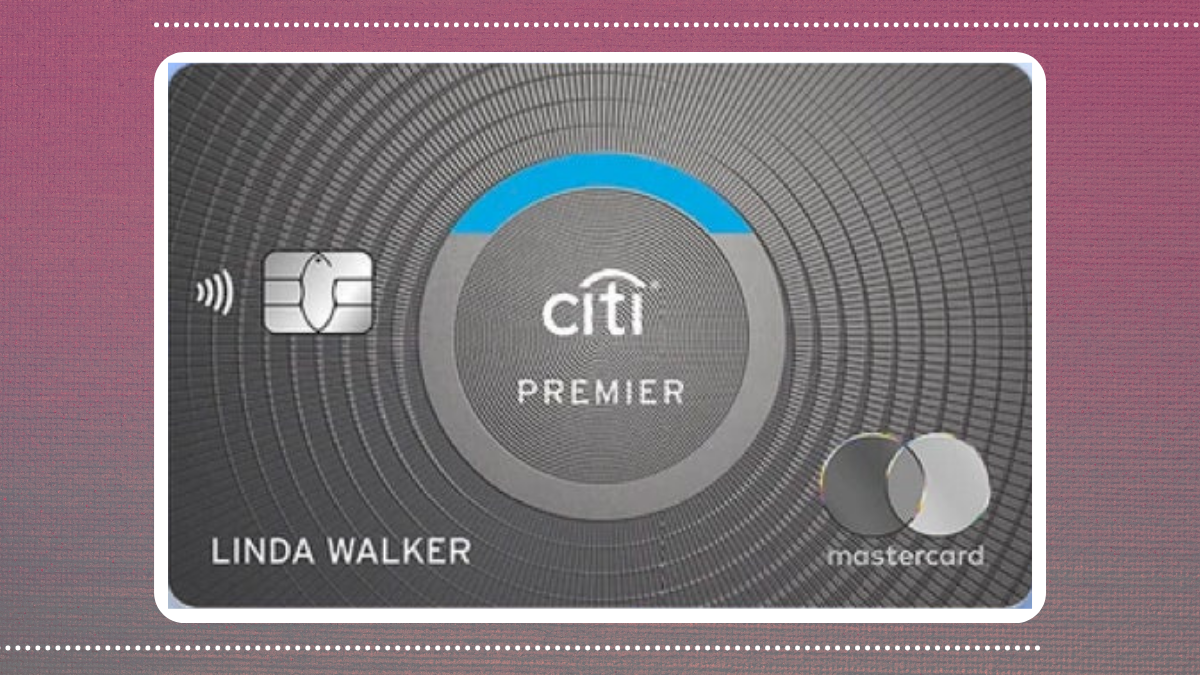

Citi Premier® review: is it worth it?

If you're looking for a travel credit card with excellent benefits, you should read this Citi Premier® review. This is the one, keep reading!

Keep Reading

Merrick Bank Personal Loan: Learn More

Start applying for a loan with Merrick Bank Personal Loan! With this company, you will be able to have your money as fast as possible.

Keep Reading

An easy guide to understanding credit scores for beginners

If you're looking for a credit card, you should first read this guide to credit scores. Learn more about it and how to improve your score.

Keep ReadingYou may also like

See how to apply for the LightStream Personal Loan

Have you already chosen the Lightstream Personal Loan, but do not know how to apply for the loan? Click this article to find out how!

Keep Reading

See how to request the Neo Financial® Credit Card

The Neo Financial credit card may be the best choice for those who want cashback and savings at the same time. See how to get it!

Keep Reading