Loan

Review Marcus by Goldman Sachs Personal Loans

If you're in search of a versatile loan option with no fees and flexible payment terms, look no further than Marcus by Goldman Sachs Personal Loans.

Advertisement

Marcus by Goldman Sachs Personal Loans: Secure Funding with Peace of Mind

In the realm of personal loans, finding a reputable lender that offers reasonable terms can be a challenge. That’s why Marcus by Goldman Sachs Personal Loans stands out from the crowd. In this comprehensive review, we will provide you with all the information you need to make an informed decision about this company, ensuring that you can achieve your financial goals without burdening yourself in the long run.

Unveiling the Marcus by Goldman Sachs Personal Loans: A Comprehensive Review

Welcome to our in-depth review of Marcus by Goldman Sachs Personal Loans, where we will dissect its key features, pros, and cons. By the end of this review, you’ll be equipped with the knowledge needed to make an informed decision. So, keep reading to discover how obtaining a personal loan from Marcus can positively impact your life without straining your budget.

Key Loan Details:

- Loan Purpose: Marcus by Goldman Sachs Personal Loans caters to various needs, including home improvement, debt consolidation, and more. Whatever your financial goals, Marcus has a loan option to support your aspirations.

- APR: Experience the benefits of a fixed APR ranging from 6.99% to 19.99%. This ensures stability and predictability in your monthly payments throughout the loan term.

- Credit Requirements: To be eligible for a Marcus personal loan, a minimum credit score of 660 is required. This provides an opportunity for individuals with a solid credit history to access favorable loan terms.

- Loan Amounts: Borrow with flexibility, as Marcus offers loan amounts starting from $3,500 and reaching up to $40,000. Tailor your loan to meet your specific financial requirements.

- Late Fee: Rest easy knowing that Marcus does not impose any late fees. This allows you to focus on managing your loan repayments without the worry of incurring additional charges.

- Early Payoff Penalty: Marcus takes a borrower-friendly approach by eliminating early payoff penalties. You have the freedom to pay off your loan ahead of schedule without any associated fees.

- Origination Fee: Enjoy the perk of no origination fees when obtaining a personal loan from Marcus. This means you can access the funds you need without any upfront costs.

In summary, Marcus by Goldman Sachs Personal Loans offers a reliable and transparent lending option that can enhance your financial well-being. With its competitive fixed APR, diverse loan purposes, generous loan amounts, and customer-focused policies, Marcus is dedicated to supporting your financial journey.

Make an informed decision and unlock the benefits of Marcus by Goldman Sachs Personal Loans. Continue reading to gain a comprehensive understanding of how this lending solution can empower you to achieve your financial goals.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Marcus by Goldman Sachs Personal Loans: A Comprehensive Guide

If you’re seeking a hassle-free borrowing experience without the burden of fees, Marcus by Goldman Sachs Personal Loans is the ideal solution. As the online banking and lending division of the esteemed Goldman Sachs, you can trust in their reputation and commitment to providing a safe and reliable service.

What sets Marcus apart from other personal loans is its fee structure. Unlike many loan providers, Marcus doesn’t charge sign-up, origination, or late payment fees. However, it’s important to note that interest charges will apply if you miss a payment.

With Marcus, you have the opportunity to borrow up to $40,000 for various purposes such as home improvement, debt consolidation, or even a dream vacation. The loan terms are flexible, offering nine different options ranging from 36 to 72 months. The fixed APR, determined by your creditworthiness, falls within the range of 6.99% to 19.99%.

Marcus by Goldman Sachs Personal Loans is available in all 50 states, and the pre-qualification process involves only a soft credit check, which won’t harm your credit score. Additionally, enrolling in autopay can qualify you for a rate discount.

Another notable feature of Marcus is their payment deferment option. After making 12 consecutive full and on-time payments, you have the opportunity to defer one monthly payment without accruing interest. The loan term will be extended by one month, providing flexibility during unexpected financial circumstances.

To help you make an informed decision, we invite you to explore our comprehensive Marcus by Goldman Sachs Personal Loans review, where we discuss the pros and cons of this lending option.

Trending Topics

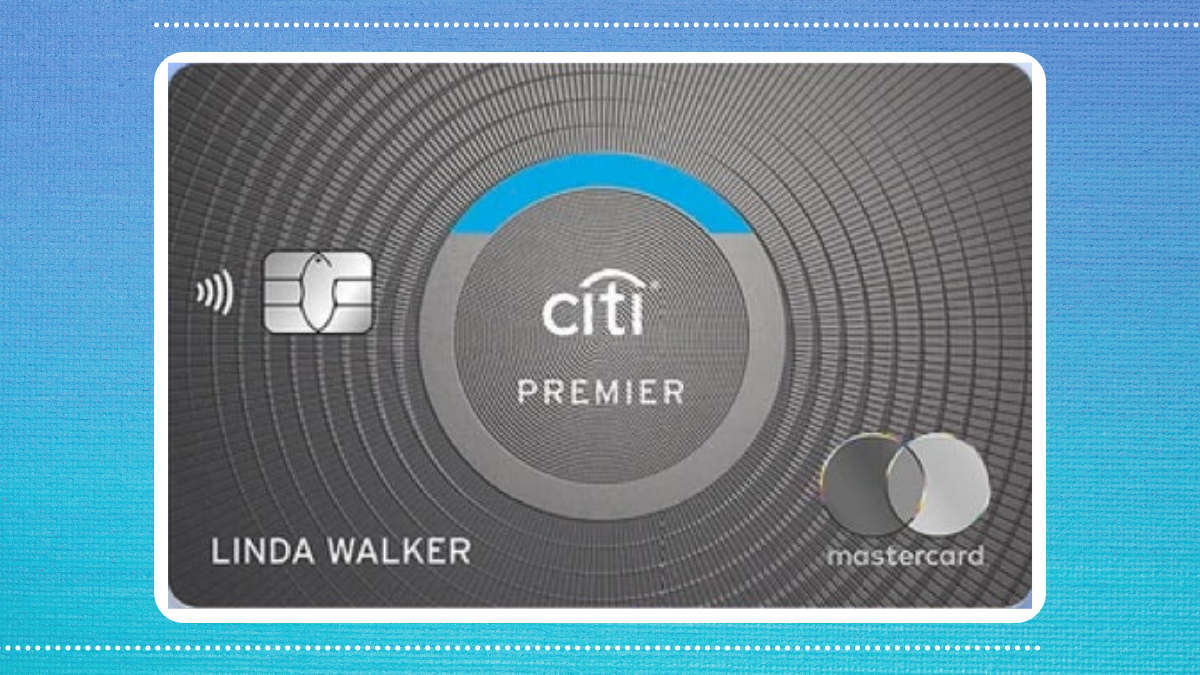

Apply for the Citi Premier® card: learn how!

Would you like to apply for Citi Premier® credit card? It has fantastic benefits even for everyday users. Learn how to ask for yours.

Keep Reading

Build your best credit score with the best credit cards in Canada!

Turning red scores to green, there's just one path forward, and it goes through the best credit cards for building credit in Canada!

Keep Reading

Home Trust Secured Visa Credit Card Review: The Category Champion

Meet the champion among secured cards. The Home Trust Secured Visa Credit Card is here to change the game!

Keep ReadingYou may also like

785 credit score is an indicator of good or bad financial health?

If you have a 785 credit score you might be feeling very proud. But is it good or bad? This article will tell you more about this score.

Keep Reading

Apply for LendKey Loan

Learn how to apply for a loan with Lendkey! Lendkey will help you with your doubts and hardships in the financial zone.

Keep Reading

Review of the Fortiva Mastercard® credit card

Find out in this article what are the requirements, advantages and disadvantages of the Fortiva Mastercard credit card!

Keep Reading